Eli Lilly’s Valuations after Its 2Q17 Earnings

Eli Lilly (LLY) surpassed Wall Street estimates in 2Q17, reporting earnings per share of $1.11 on revenues of ~$5.8 billion. Analysts estimated that the company would report EPS of $1.05 on revenues of $5.6 billion.

Aug. 31 2017, Published 3:02 p.m. ET

Eli Lilly & Co.’s valuations

Headquartered in Indianapolis, Indiana, Eli Lilly & Co. (LLY) is a US pharmaceuticals company focused on human pharmaceuticals and animal health products.

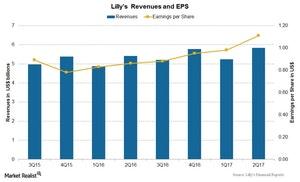

The chart below shows the revenues and earnings per share (or EPS) of Eli Lilly since 3Q15. Eli Lilly surpassed Wall Street analysts’ estimates, reporting EPS of $1.11 on revenues of ~$5.8 billion for 2Q17. Analysts estimated that the company would report EPS of $1.05 on revenues of $5.6 billion during 2Q17.

Forward PE

PE (price-to-earnings) multiples represent what one share can buy for an equity investor. On August 30, 2017, Eli Lilly & Co. (LLY) was trading at a forward PE multiple of ~17.9x, compared to the industry average of ~15.5x.

Among LLY’s competitors, Bristol-Myers Squibb (BMY), Johnson & Johnson (JNJ), and Merck & Co. (MRK) have forward PE multiples of 18.8x, 17.5x, and 15.5x, respectively.

Forward EV-to-EBITDA

On a capital structure–neutral and excess cash–adjusted basis, Eli Lilly currently trades at a forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple of ~13.3x, which is higher than the industry’s average of ~11.6x.

Among its competitors, Bristol-Myers Squibb (BMY), Johnson & Johnson (JNJ), and Merck & Co. (MRK) have forward EV-to-EBITDA multiples of 15.7x, 13.4x, and 11.6x, respectively.

Analyst recommendations

Eli Lilly’s stock price has risen ~6.8% in 2017 year-to-date. Analysts estimate that the stock has the potential to return ~13.9% over the next 12 months. Analysts’ recommendations show a 12-month targeted price of $89.43 per share compared to the last price of $78.55 per share on August 29, 2017.

Of the 22 analysts tracking Eli Lilly stock, 14 analysts recommend a “buy,” seven analysts recommend a “hold,” and one analyst recommends a “sell.” The current recommendation for Eli Lilly stock is ~2.2 on a scale of 1 (strong buy) to 5 (strong sell), which shows a moderate buy for long-term investors.

To divest any company-specific risks, investors can consider ETFs like the iShares US Pharmaceuticals ETF (IHE), which holds 5.7% of its total assets in Eli Lilly (LLY). IHE also holds 10.1% in Johnson & Johnson (JNJ), 7.7% in Merck & Co. (MRK), and 6.7% in Bristol-Myers Squibb (BMY).