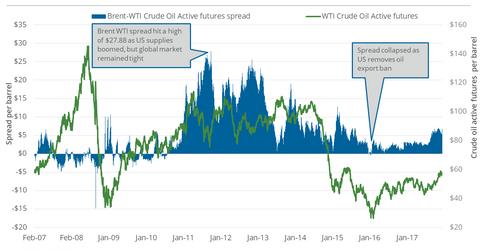

Brent Is Outperforming WTI Crude Oil

On December 11, 2017, Brent crude oil (BNO) active futures settled $6.7 more than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

Nov. 20 2020, Updated 12:59 p.m. ET

The spread

On December 11, 2017, Brent crude oil (BNO) active futures settled $6.7 more than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures. The Brent-WTI spread was at $4.98 on December 4, 2017. On December 4–11, 2017, Brent crude oil February 2018 futures rose 3.6%, while US crude oil January futures rose 0.9%. As a result, the Brent-WTI spread expanded. A higher rise in Brent crude oil prices could be due the Forties Pipeline shutting down in the North Sea and the fear of a strike in Nigeria. WTI crude oil prices are weaker because of record US crude oil production. In Part 2, we discussed US crude oil production.

US oil exports

For the week ending December 1, 2017, US crude oil exports were at ~1.36 MMbpd (million barrels per day). From the same period in 2016, US crude oil exports have risen by 859,000 barrels per day. The Brent-WTI spread rose ~$3.9 during this period—an incentive for US crude oil exporters.

A relatively higher Brent-WTI spread would mean less revenue for US oil producers (XOP) (DRIP) for their output in the US market benchmarked to WTI crude oil—compared to their international peers, whose output is benchmarked to Brent crude oil prices.

However, US refiners (CRAK) could take advantage of the price difference. Their profits could rise by using cheaper US crude oil as input, while their output is benchmarked to stronger Brent crude oil prices. In the trailing week, the VanEck Vectors Oil Refiners ETF (CRAK), which tracks global refining stocks, rose 1.3%.

Visit Market Realist’s Energy and Power page for crucial energy updates.