These Pfizer Products Lost Market Share in 3Q17

BeneFIX revenues fell 14% to $151 million during 3Q17, driven by a 16% fall in international sales to $87 million.

Nov. 7 2017, Updated 9:02 a.m. ET

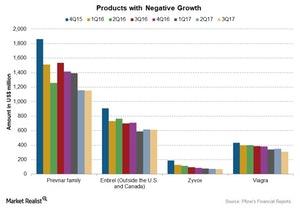

Products losing market share in 3Q17

Pfizer’s (PFE) portfolio includes products that are losing market shares due to competition with its Innovative Health Essential Health segment.

Negative growth products

BeneFIX revenues fell 14% to $151 million during 3Q17, driven by a 16% fall in international sales to $87 million, and an 11% decline in US sales to $64 million.

Enbrel, a blockbuster drug, reported a 13% fall to $613 million in 3Q17, including sales outside the US and Canada.

EpiPen, Mylan’s (MYL) blockbuster drug, contains a drug manufactured by Pfizer. Pfizer reported a 25% decline in revenues for EpiPen to $82 million, driven by lower sales in the US markets, partially offset by increased sales of EpiPen in international markets.

Inylta, an oncology drug, reported a 12% decline in its revenues to $84 million in 3Q17, driven by a 15% decline in US sales to $30 million, and a 10% decline in international sales to $53 million.

Other big losers

The Prevnar family of drugs reported a 1% fall in sales to $1.52 billion in 3Q17, driven by a 4% fall in US sales to $971 million and offset by 5% growth in international sales to $551 million.

Viagra reported a 20% fall in revenues to $308 million during 3Q17, driven by a 32% fall in US sales to $198 million but substantially offset by 13% growth in international sales to $111 million.

Zyvox reported a 28% fall in revenues to $68 million in 3Q17, driven by a 66% fall in US sales to $6 million and a 19% fall in international sales to $62 million, due to patent expiry and competition since 2Q15. Pristiq, Revatio, Precedex, Fragmin, Tygacil, Norvasc, and the Premarin family all reported revenue declines in 3Q17.

Notably, the iShares Core High Dividend ETF (HDV) has 5.2% in Pfizer (PFE). HDV also has 5.8% in Johnson & Johnson (JNJ), and 3.3% in Merck (MRK).