Will PotashCorp Report Flat Earnings Growth in 2Q17?

PotashCorp (POT) had lackluster earnings growth last year. However, the company reported EPS (earnings per share) growth in 1Q17.

July 19 2017, Updated 3:35 p.m. ET

EPS growth

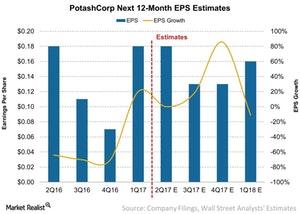

PotashCorp (POT) had lackluster earnings growth last year. However, the company reported EPS (earnings per share) growth in 1Q17. The trend was a departure from its previous four quarters.

The industry has experienced anemic growth. There was slow growth across the board for fertilizer players (NANR) including Mosaic (MOS), Agrium (AGU), Intrepid Potash (IPI).

2Q17 earnings

Wall Street analysts expect PotashCorp to report EPS of $0.18. Compared to its EPS in 1Q16, PotashCorp will likely deliver flat growth YoY (year-over-year). As we step into the next four quarters, Wall Street analysts expect the company to report EPS of $0.6, which will likely grow 11.1% YoY in the recent four quarters.

While the earnings growth isn’t spectacular, it’s a positive signal that the worst might be over for PotashCorp. Earlier, we discussed that the gross margins could be offset by expectations of higher operating costs, which could trickle down to earnings growth as well.

What will drive earnings?

The fertilizer industry will see positive momentum in earnings when fertilizer price realizations improve. Since the demand side hasn’t absorbed the excess capacity buildup, there’s still a ceiling on fertilizer prices.

In the next part, we’ll discuss capital expenditure expectations.