Brent Underperforming US Crude Oil: Impact on US Oil Exports

In 2017 year-to-date, US crude oil exports averaged ~782,700 barrels per day, based on weekly data from the EIA (Energy Information Administration).

Nov. 20 2020, Updated 4:15 p.m. ET

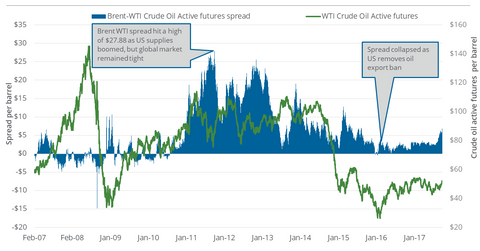

Brent–WTI spread

On October 3, 2017, Brent crude oil (BNO) active futures settled $5.60 above US crude oil (USO) (DBO) active futures. On September 26, 2017, the difference between the two grades of oil, or the Brent–WTI spread, was $6.60.

US crude oil November futures fell 2.8%, while Brent crude oil December futures fell 3.3% during the seven calendar days through October 3, 2017.

On a month-over-month basis, Iraq’s oil exports gained slightly in September 2017. A Reuters survey indicated a rise in OPEC’s output on September 29, 2017. These are bearish factors for the international oil benchmark, Brent. Earlier in this series, we discussed several bullish factors affecting US crude oil prices.

A combination of bearish factors for Brent and bullish factors for WTI can explain the fall in the Brent–WTI spread.

Brent–WTI spread and US oil exports

In 2017 year-to-date, US crude oil exports averaged ~782,700 barrels per day, based on weekly data from the EIA (Energy Information Administration). This figure was 62.2% higher than the average during the same period in 2016.

The Brent-WTI spread rose after Hurricane Harvey, which would encourage exports from the US to international markets. So, any fall in the Brent–WTI spread could reduce the profit of the US crude oil exporters.

However, a fall in the spread could mean higher domestic prices for US crude oil producers (XOP)(DRIP)(IEO) compared with their international peers. However, contraction in the spread could cause US refineries’ (CRAK) profitability to fall due to the difference between their input costs and output realized prices.

Please visit Market Realist’s Energy and Power page for ongoing updates on the energy sector.