What to Expect from the US Dollar

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

July 31 2017, Updated 4:05 p.m. ET

US dollar continued to slide

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data. The US Dollar Index closed at 93.11 in the previous week—compared to 93.68 in the week before. The index is heading for another negative monthly close—five negative closes in a row. The FOMC’s statement was in line with expectations. However, a slightly dovish shift in inflation outlook led investors to reduce the chances for another rate hike from the US Fed this year. Now, the Fed futures point to a 40% probability of another rate hike in 2017—down from 51% before the FOMC’s statement.

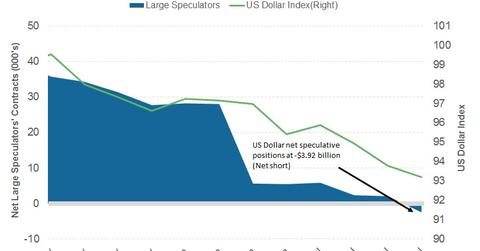

Positions on the US dollar remain bearish

According to the latest “Commitment of Traders” report released on July 28 by the Chicago Futures Trading Commission, large speculators and traders have remained bearish on the US dollar for a second week in a row. According to calculations from Reuters, net US dollar (USDU) positions increased to -$3.92 billion—compared to -$1.91 billion in the previous week. The amount is a combination of the US dollar’s contracts against the euro’s (FXE) combined contracts—the British pound (FXB), Japanese yen (FXY), Australian dollar (FXA), Canadian dollar (FXC) and Swiss franc. Such an increase in short positions could mean that traders are expecting more declines in the US dollar.

This week is important

The focus will now turn towards the economic data. There aren’t any Fed meetings in August. On Friday, the non-farm payrolls data will seal the US dollar’s fate for the month ahead. The market consensus is for 180,000 jobs being added in July—compared to 222,000 jobs in June. The market expects the jobless rate to remain below 4.4%. If these expectations are exceeded, we can hope for a recovery. Otherwise, the slide in the US dollar will likely continue. Other economic data slated to be released this week includes pending home sales, ISM manufacturing data, and ISM non-manufacturing data.