Natural Gas Traders Should Stay Cautious of Oil Rigs

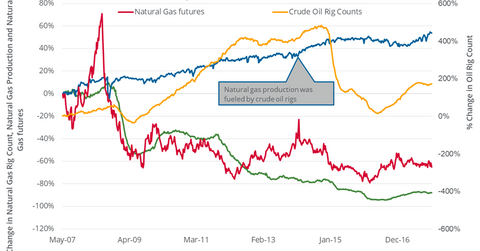

On December 29, the natural gas rig count was 88.7% below its record high of 1,606 in 2008. However, natural gas supplies have risen drastically since 2008.

Nov. 20 2020, Updated 3:53 p.m. ET

Natural gas supplies depend on the oil rigs

On December 29, 2017, the natural gas rig count was 88.7% below its record high of 1,606 in 2008. However, natural gas supplies have risen drastically since 2008.

Natural gas is a frequent outcome when oil is being extracted. The oil rig count, a proxy for oil drilling activities, could be an important indicator for natural gas supplies.

In the week ending December 29, the US oil rig count was unchanged at 747. On December 29, 2017, US crude oil (USL) (OIIL) prices were at the highest closing level since June 24, 2015. Based on the oil prices and the oil rig count pattern, the oil rig count could see an upside between January and June 2018. It could increase concerns about natural gas supplies.

Natural gas–weighted stocks like Antero Resources (AR) and Gulfport Energy (GPOR) might care about a possible fall in natural gas prices based on the correlations of these stocks with natural gas prices.

Natural gas rig count

On December 29, the natural gas rig count fell by two to 182. However, the natural gas rig count was 37.9% higher compared to the level the previous year. During this period, natural gas supplies rose 9.3% and natural gas (GASL) prices fell 17.9%. Any rise in the natural gas rig count could suppress natural gas’s gains.