Shipments for PotashCorp’s Phosphate Segment See Strong Growth

PotashCorp’s (POT) phosphate segment contributed almost a fourth of overall sales for 2Q17. Sales were driven by shipments and price realizations.

Aug. 2 2017, Updated 7:36 a.m. ET

Phosphate segment’s shipments

PotashCorp’s (POT) phosphate segment contributed almost a fourth of overall sales for 2Q17. Sales were driven by shipments and price realizations. Much like the company’s potash and nitrogen segments, shipments for phosphate fertilizers saw positive momentum in 2Q17. Positive shipments in phosphate are the only positive news for other fertilizer producers (NANR) such as Mosaic (MOS), Agrium (AGU), and Israel Chemicals (ICL).

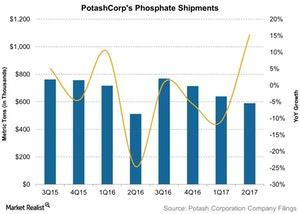

2Q17 shipments

In 2Q17, phosphate shipments saw a strong upward momentum year-over-year for PotashCorp. They rose 15.0% year-over-year to 590,000 metric tons, from 512,000 metric tons in 2Q16.

Breaking it down by segments, the company ships phosphate products to agricultural users as fertilizers as well as for feed and industrial products. The strongest momentum in phosphate sales came from the fertilizer subsegment, whose shipments rose 27.0% year-over-year to 348,000 metric tons, from 274,000 metric tons. The feed and industrial segment’s shipments rose only 2.0% year-over-year to 242,000 metric tons in 2Q17, from 238,000 metric tons in 2Q16.

PotashCorp’s phosphate segment and nitrogen segment continue to remain weak. In the next part of this series, we’ll look at the company’s price momentum for phosphate fertilizers.