Are Small Caps Worth the Risk Right Now?

The small-cap stock universe started rallying after Trump’s victory in November.

Oct. 12 2017, Updated 11:13 a.m. ET

Risks potentially worth taking

High-quality small caps: It would be hard to argue that small-cap stocks are screaming bargains. The Russell 2000 is valued at 28x forward earnings. However, after excluding companies with negative profits, the valuation comes down to a more reasonable 19.5x. Small-cap companies often have better earnings growth prospects than their already-large peers. Also, small companies can benefit from being acquired at a premium to their market price and tend to be oriented to the domestic U.S. economy, which has been healthier than other regions in recent years. Furthermore, as a result of being more domestic, they tend to pay higher effective tax rates and will disproportionally benefit if corporate tax rates are cut.

Market Realist

Are small-cap stocks looking good?

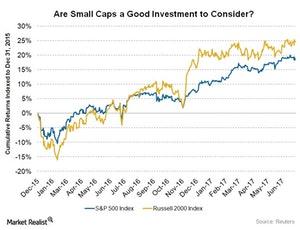

The small-cap stock universe started rallying after Trump’s victory in November. Many investors and wealth managers believed that President Trump’s stance on lowering taxes and reducing regulations could benefit the small-cap space. As of June 30, the small-cap universe as represented by the Russell 2000 Index (IWM) has risen 18%.

Small-cap companies offer investors more room for growth since their focus is on domestic companies. Thus, any change in the US economy has a direct impact on small-cap companies’ earnings.

The strengthening US economy could also lead to a rise in dollar (UUP) growth. A strong dollar and trade reforms by the new administration could affect large-cap companies (OEF) that derive a lump sum of their revenue from overseas operations, ultimately benefitting small caps.

Historical data have shown that small caps outperform large caps when the dollar is rising. Small-cap companies (IWM) (VTI) are unaffected by the strengthening dollar since they operate domestically.

What could challenge small-cap performance?

President Trump campaigned on lower tax rates, deregulation, and higher infrastructural spending. These policies aren’t expected to show any effect until 2018 or later. This is ultimately taking a toll on the earnings of small-cap companies, as small caps by and large pay the highest in corporate taxes.

Rising interest rates could also prove to be a headwind for small-cap companies. Lower rates in 2016 supported the Russell 2000 Index performance. However, after the three rate hikes since December 2016, the Fed is expected to raise interest rates one more time this year. The Fed aims to reach its targeted rate of 2% this year.

Further rate hikes this year leading to higher inflation could hold back the current small-cap stock performance. As of June 30, 2017, the Russell 2000 Index has underperformed, gaining just 4% compared to an 8% gain by the S&P 500 Index (SPY) (SPX-Index) year-to-date. A recent report by Furey Research Partners stated that 1Q17 earnings growth for the Russell 2000 was up 9.7% year-over-year. On the contrary, earnings growth for the S&P 500 was 13.9% for 1Q17. For the small-cap index to continue its rally, earnings need to rebound as they have for large caps. It goes without saying that small caps also carry greater risk than large-cap companies due to their lower market capitalization. So could small caps be a risk potentially worth taking?

In the last part of the series, we’ll discuss if investing in REITs is a risk worth taking.