Hedge Funds’ Net Bullish Positions on US Crude Oil

Hedge funds reduced their net bullish positions in US crude oil futures and options by 1,136 contracts to 133,606 contracts on June 20–27, 2017.

Nov. 20 2020, Updated 1:46 p.m. ET

Hedge funds

The U.S. Commodity Futures Trading Commission released its weekly “Commitments of Traders” report on June 30, 2017. It reported that hedge funds reduced their net bullish positions in US crude oil futures and options by 1,136 contracts to 133,606 contracts on June 20–27, 2017. It’s the lowest level in the last 11 months.

It indicates that hedge funds (or money managers) are bearish on crude oil (FENY) (FXN) (SCO) prices despite the production cut deal. The rollercoaster ride in crude oil prices impacts oil and gas producers’ earnings like SM Energy (SM), Chevron (CVX), Denbury Resources (DNR), and Noble Energy (NBL).

Crude oil price forecasts

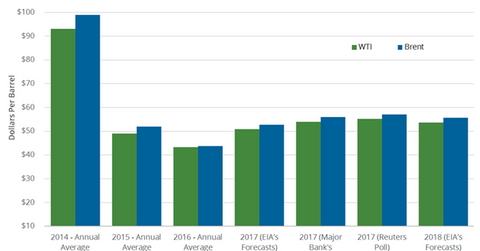

A Wall Street Journal survey of 14 investment banks predicts that US crude oil prices will average $52 per barrel in 2017—$2 per barrel lower than the May 2017 survey. Likewise, a Wall Street Journal survey forecasts that Brent crude oil prices will average $55 per barrel in 2017, respectively—$2 per barrel lower than the May 2017 survey.

The survey stated that Brent crude oil would average $57 per in 2018—$2 per barrel lower than the May 2017 survey. The survey also stated that WTI crude oil would average $55 per barrel in 2018—$3 per barrel lower than the May 2017 survey.

WTI and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel in 2016, respectively.

Higher crude oil production from the US, Libya, and Nigeria could pressure crude oil prices in 2017 and 2018.

Read Why Brent and US Crude Oil Futures Could Make a U-Turn and US Crude Oil Production and Rigs Drive Prices to learn more about crude oil.

Read Looking Ahead: Natural Gas and Crude Oil Prices Next Week for more on natural gas prices.