Why Boston’s Rosengren Feels It’s Hard to Fight Future Recessions

In Eric S. Rosengren’s view, monetary policy measures become incapable of fighting future negative shocks if interest rates (AGG) are already low.

June 29 2017, Updated 10:37 a.m. ET

Comments at the Riksbank macroprudential conference

The president of the Boston Federal Reserve, Eric S. Rosengren, gave a presentation on financial stability in a low-interest-rate environment at the De Nederlandsche Bank and Sveriges Riksbank macroprudential conference series in Amsterdam.

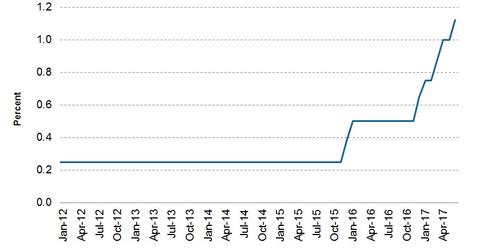

Rosengren isn’t a voter this year, but he’s been a hawk since the first rate hike of this cycle in December 2015. In his presentation, he has argued that low interest rates (BND) place economies at risk and make it difficult to fight future recessions.

Low rates pose financial stability risks

In Rosengren’s view, monetary policy measures become incapable of fighting future negative shocks if interest rates (AGG) are already low. This has been the case recently, with many leading central banks in the world having to deal with near-zero interest rates.

In a low-interest rate environment, the yield curve becomes sensitive to policy decisions. On the back of this argument, Rosengren has advocated slowly raising the US interest rate (BSV) as the economy approaches normalcy.

Low rates will lead to extraordinary policy measures

Rosengren said that the lack of interest rates as a monetary policy tool would lead to central banks’ taking extraordinary monetary policy measures.

This was the case in the recent downturn, when central banks in the United States (SPY) (GVI), Europe, the United Kingdom, and Japan (EWJ) had to resort to quantitative easing. All these banks are now facing the risk of an unstable economy as they struggle to plan their exits from these measures.

In the next article, we’ll analyze the New York Fed president’s opinion that a flattening yield curve isn’t a negative signal.