How AstraZeneca’s Oncology Segment Performed in 1Q17

AstraZeneca’s (AZN) Oncology segment has consistently reported revenue growth over the last few years, and it’s one of the company’s key areas of focus.

May 30 2017, Updated 9:06 a.m. ET

Oncology segment

AstraZeneca’s (AZN) Oncology segment has consistently reported revenue growth over the last few years, and it’s one of the company’s key areas of focus.

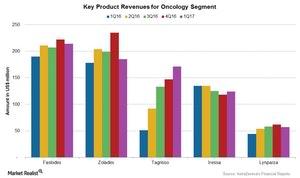

The segment reported a rise of 21% in its 1Q17 revenue at a constant exchange rate. Its reported revenue was $885 million in 1Q17, driven by revenue growth in Tagrisso and Lynparza, along with its legacy products such as Faslodex and Zoladex. Its revenue rise was partially offset by the weak performances of Iressa, Casodex, and Arimidex.

Faslodex

Faslodex is an oncology drug used for the treatment of post-menopausal women with advanced or metastatic breast cancer. The drug reported a revenue rise of 13% at constant exchange rates to $214 million in 1Q17. Its growth was driven by strong performances in US and emerging markets, partially offset by lower sales in European markets.

Zoladex

Zoladex is an oncology drug used for the treatment of prostate cancer in men and breast cancer or endometriosis in women. Zoladex reported a revenue rise of 5% at constant exchange rates to $185 million in 1Q17. The rise was driven by the drug’s strong performance in emerging markets, substantially offset by lower sales in the US and European markets.

Lynparza

Lynparza, a drug for treating ovarian cancer, reported a 32% revenue rise at constant exchange rates to $57 million in 1Q17. The growth was driven by the drug’s strong performance in European markets, partially offset by its lower sales in US markets.

Tagrisso

Tagrisso is one of the new drugs in AstraZeneca’s Oncology segment. The drug reported a rise of over 100% in revenue to $171 million in 1Q17.

To divest risk, investors can consider ETFs such as the iShares S&P Global 100 ETF (IOO), which holds ~0.7% of its total assets in AstraZeneca. IOO also holds 3.1% of its total assets in Johnson & Johnson (JNJ), 2.0% in Novartis (NVS), and 1.8% in Merck & Co. (MRK).