Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

May 18 2017, Updated 2:36 p.m. ET

VanEck

How fallen angels may complement high yield portfolios

Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur in stressed markets. At the same time, investors should consider the group’s overweights to the energy and basic industry sectors, and factor in views on oil prices, which have meaningfully influenced returns in these two sectors. Historically, differences in sector allocations versus broad market high yield bonds have, on average, helped offset some of the negative impact from rising interest rates. VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL) received a three-year and overall five-star rating from Morningstar, as of March 31, 2017.[8.Morningstar ratings: ©Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. As of March 31, 2017, ANGL was rated against 596 high yield bond funds over the last three years. ANGL received a Morningstar Rating of 5 stars for the 3-year and overall rating. Past performance is no guarantee of future results.] ANGL was rated against 596 funds in Morningstar’s high-yield bond category based on total returns. Past performance is no guarantee of future results. Additional resources and information on VanEck Vectors Fallen Angel High Yield Bond ETF.

Market Realist

Risk-adjusted returns

Fallen angel bonds have higher risk-adjusted returns than high-yield bonds, treasury bonds, and the S&P 500. And risk-adjusted returns are measured by the Sharpe ratio.

But the higher returns and lower volatility of these bonds relative to the S&P 500 (SPY) (SPX-INDEX) have translated into the highest Sharpe ratios for fallen angel bonds. Notably, VanEck reduced the fees on fallen angel bonds (ANGL) from 0.40% to 0.35% in June 2016.

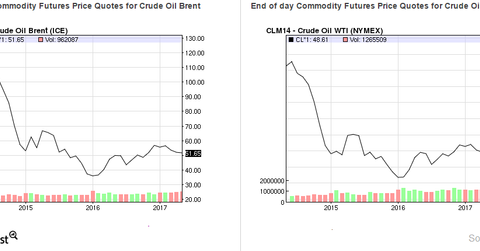

The effect of OPEC’s production cut on oil prices

The US imported 10.1 million barrels per day in 2016. OPEC (Organization of the Petroleum Exporting Countries) accounted for 34% of these imports, with the top five countries accounting for US oil imports.

To be sure, the extension of the production cut decision between OPEC and non-OPEC countries will play a vital role in shaping the future trajectory of oil prices.

On May 15, 2017, the energy ministers of Saudi Arabia and Russia announced a production cut, extending from the middle of 2017 to March 2018. This cut has caused Brent crude futures (BNO) and US West Texas Intermediate crude futures (UCO) to rise 1.6% each. However, the US did not support the initiative and has recorded a growth of 10% in crude production since mid-2016.

The importance of policies and fundamentals

Meanwhile, US President Donald Trump’s tax reform plans, trade policies, and energy policies could be deciding factors in the fate of energy companies—if he can get these measures passed. The measures include his proposed border adjustment tax, trade barriers with Mexico, and pro-non-renewable energy policies. After all, the most oil dominant country is not 100 percent self-reliant.

The growth in the non-farm payroll and the dip in the unemployment rate in April have meanwhile strengthened the possibility of a Fed rate hike in June 2017.

While fallen angel bonds strike a perfect balance between high-yield bonds (SJNK) (PHB) and junk bonds (HYS) (SHYG), however, investors need to monitor index performances closely and analyze changing fundamentals before investing.