VanEck Vectors Fallen Angel High Yield Bond ETF

Latest VanEck Vectors Fallen Angel High Yield Bond ETF News and Updates

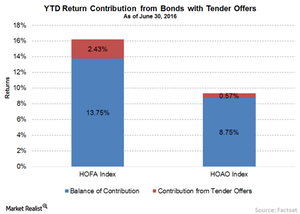

How Bond Buybacks Add Value

As of June 30, 11 fallen angel companies had issued tender offers YTD, boosting their bond prices by 5% on average.

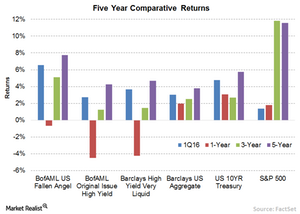

Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

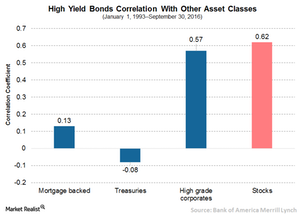

How High-Yield Bonds Are Connected to Other Asset Classes

AB Looks Are Deceiving But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking […]

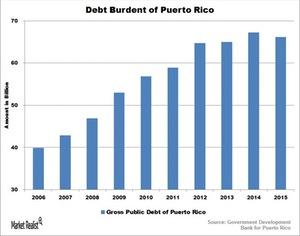

Looming Uncertainty of Puerto Rico’s Debt Crisis

Puerto Rico is currently in a meltdown mode. Over the past decade, it has accumulated $70.0 billion in public debt, which is close to 68.0% of its GDP.

How Fallen Angels Could Reward Investors

Fallen angel bonds—high-yield bonds originally issued with investment grade credit ratings—are generally known for offering potential value. A big source of this value has been the tendency of fallen angels to be oversold below what may be considered fair value, leading to a downgrade to high yield. A less obvious source of value for fallen angels […]

Interest Rate Outlooks Don’t Affect All Asset Classes: Here’s Why

Historically, it seems that fallen angels generally perform well across interest rate environments.