PowerShares Fundamental HiYld CorpBd ETF

Latest PowerShares Fundamental HiYld CorpBd ETF News and Updates

High-Yield Bonds Are Turning Out to Be the Real Winners

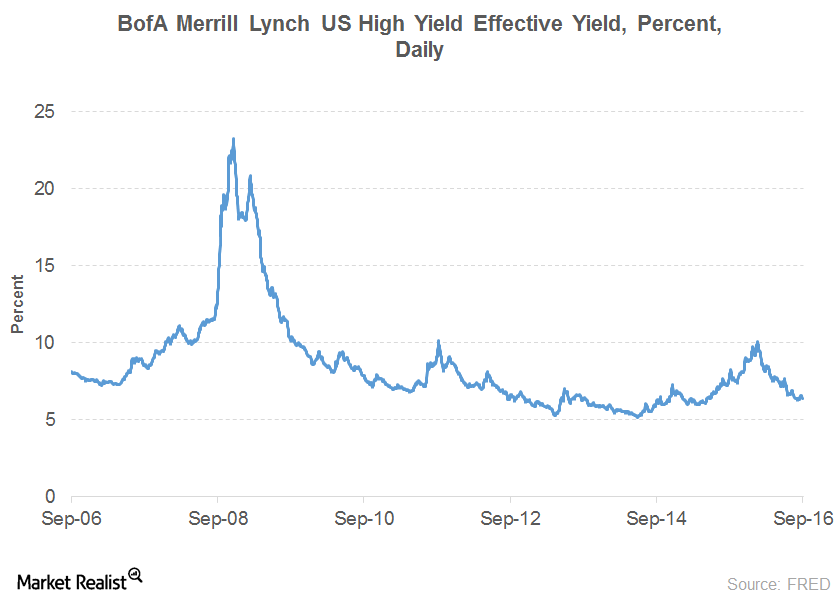

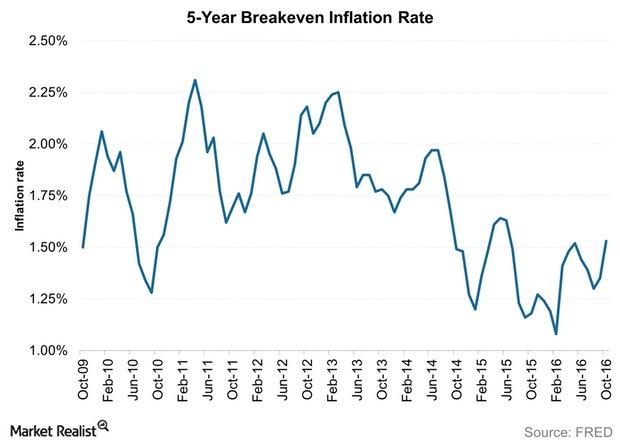

High-yield bonds gained popularity due to higher yields compared to Treasury bonds, whose yields were being pushed down by the Fed’s interest rate policy.

Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

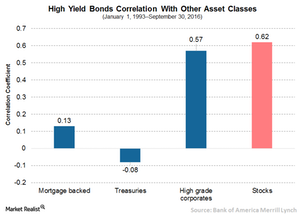

How High-Yield Bonds Are Connected to Other Asset Classes

AB Looks Are Deceiving But even though high-yield bonds look like other bonds, they don’t necessarily act like other bonds. This insight can have important implications for how investors consider them in an overall portfolio context. High-yield performance patterns, for example, don’t track those of other fixed-income sectors very closely over the long term. Looking […]

Why High Yield Bonds Are Attractive

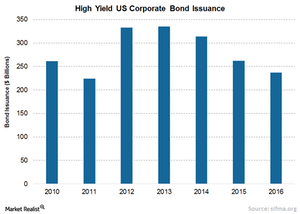

In this series, we’ll discuss the many advantages of high yield bonds, their correlation with other asset classes, the rise of global high yield markets, and why high yield bonds should command a place in a portfolio.

Why Richard Bernstein Sees Risk in ‘Safe’ Investments

Richard Bernstein believes that investors’ flocking to fixed-income products and shunning equities has increased their risk.

Why Is ‘Carry’ Compressed in Financial Markets?

In his investment outlook for June 2016, Bill Gross asserted that “carry” is compressed in nearly every form. It has more risk than return.