Consumer Activity Is on the Rise in India

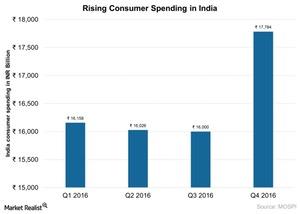

Consumer spending in India (INDL) stood at ~17.8 trillion rupees in 4Q16, an 11% increase compared to 16.0 trillion rupees in 3Q16.

Nov. 20 2020, Updated 1:53 p.m. ET

Demonetization effect receded

Consumer sentiment in India is improving and has an optimistic outlook for the medium term, as noted by P.B. Balaji, the CFO of Hindustan Unilever (HUL). However, a potential short-term disruption due to the implementation of the Goods and Services Tax (or GST) starting on July 1, 2017, is expected in the near term.

The effect of demonetization seems to have receded as consumer spending in India is expected to increase to ~17.9 trillion rupees by the end of 1Q17, according to analyst estimates. Let’s look at consumer spending over the last year in the chart below:

Consumer spending in India

Consumer spending in India (INDL) stood at ~17.8 trillion rupees in 4Q16, an 11% increase compared to 16.0 trillion rupees in 3Q16. The growing middle class with rising incomes in India (EPI) (INDA) is expected to fuel strong economic growth over the medium term.

The expectations of a normal monsoon season, along with increased government spending in 2017, could boost rural incomes. The stability in Indian markets recently led the Central Bank of India to change its stance from “neutral” to “accommodative” in February 2017, supporting consumer spending. The Reserve Bank of India (or RBI) is expected to continue this course and cut interest rates further.

Size of the Indian market

India is expected to become the third-largest consumer economy by 2025, according to a March 2017 report released by Boston Consulting Group’s Center for Customer Insight. The Indian economy is expected to grow at a rate of 12% year-over-year, which is more than double the anticipated global (ACWI) (VT) rate of 5%.

Resultantly, the consumer discretionary sector has been one of the top-performing sectors in India in 2017. The consumer discretionary sector has gained ~28% year-to-date through May 18, 2017. The ambitious reforms led by Prime Minister Narendra Modi and his government are also attracting support from international investors in India.

The EGShares India Consumer ETF (INCO) tracks the India Consumer Index, which is a market-cap-weighted index of about 30 Indian consumer discretionary stocks. INCO has gained about 20% so far year-to-date through May 18, 2017.

In the next article, we’ll look at the increasing foreign direct investment in India.