Fewer Analysts Recommend ‘Buys’ on American Airlines

Analysts’ “hold” ratings on American Airlines stock have risen significantly. Nine analysts, a total of 56.3%, now have “hold” ratings on the stock.

Nov. 20 2020, Updated 12:23 p.m. ET

Analysts’ views

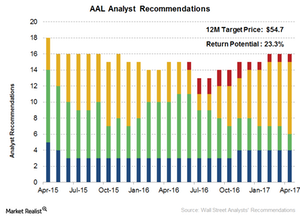

According to a Reuters consensus, of the 16 analysts tracking American Airlines (AAL), four have “strong buy” recommendations on the stock, and two have “buy” ratings. Together, this makes up 37.5% of analysts, fewer than the 50% that had “buy” or similar ratings on the stock in both 4Q16 and 3Q16, and fewer than the 71.4% that had “buy” ratings on the stock in 2Q16.

Analysts’ “hold” ratings on the stock have risen significantly. Nine analysts, a total of 56.3%, now have “hold” ratings on the stock, compared to the five analysts, or 35.7%, that gave it similar ratings in 4Q16. One analyst had a “sell” rating on AAL at the end of 1Q17.

Target price

However, some analysts have increased their target prices on the stock. American Airlines’ consensus-12-month target price is now $54.7, compared to its level of $52.1 at the end of 4Q16 and $41.17 at the end of 3Q16. Its current target price suggests a 23.3% return potential compared to its April 19, 2017, closing price of $44.4.

The stock’s highest target price is of $95, and its lowest target price is of $40. American Airlines forms 2.7% of the PowerShares Dynamic Market ETF (PWC).

Series overview

AAL is expected to announce its 1Q17 earnings results on April 27, 2017. In the next few articles, we’ll discuss what led to these estimates, helping investors to judge whether analysts are being optimistic or conservative on the stock. We’ll also help you to understand what may be priced into the stock.

You can also check out analysts’ estimates for Delta Air Lines (DAL), United Continental (UAL), and Alaska Air Group (ALK). Investors can gain exposure to American Airlines by investing in the PowerShares Dynamic Large Cap Value ETF (PWV), which invests ~1.4% of its portfolio in the stock.