How Bristol-Myers Squibb’s Oncology Segment Performed in 2016

Given the strong performance of Opdivo, Bristol-Myers Squibb’s Oncology segment emerged as its largest revenue contributor in 2016. The segment contributed ~35% of BMY’s total revenue.

March 16 2017, Updated 4:35 p.m. ET

The Oncology segment

Given the strong performance of Opdivo, Bristol-Myers Squibb’s (BMY) Oncology segment emerged as its largest revenue contributor in 2016. The segment contributed ~35% of BMY’s total revenue in the year.

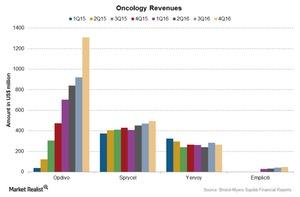

The key products in the Oncology segment include Opdivo, Empliciti, Yervoy, and Sprycel. Let’s take a look at these drugs and their performances.

Opdivo

Opdivo, whose generic name is nivolumab, is a human PD-1 blocking antibody that’s used in lung cancer and melanoma treatments. Opdivo is part of BMY’s alliance with Ono Pharmaceutical Company. Opdivo is the seventh drug to get FDA approval for the treatment of melanoma since 2011.

Opdivo reported sales of $3.8 billion in 2016. What does Bristol-Myers Squibb expect from Opdivo? We’ll find out in the next article.

Empliciti

Empliciti, a new oncology drug, was launched in US markets in December 2015 and in European markets in May 2016. The drug reported revenue of $150 million in 2016.

Sprycel

Sprycel, an oral inhibitor, reported a rise of ~13% to $1.8 billion in its 2016 revenue compared to 2015. The rise followed increased demand for the drug in US markets.

Yervoy

Yervoy is a monoclonal antibody used to treat melanoma. Yervoy’s revenue fell 6% to $1.1 billion in 2016, compared to $1.3 billion in 2015. Yervoy’s revenue saw a 33% rise in US markets, though the rise was offset by a fall in the drug’s international revenue due to competition.

Merck & Co.’s (MRK) Keytruda (pembrolizumab) is a better first-line therapy compared to Yervoy, and this affected Yervoy’s sales.

Erbitux

BMY transferred the North American manufacturing and marketing rights for Erbitux to ImClone Systems, a wholly-owned subsidiary of Eli Lilly (LLY), in October 2015.

To divest risk, investors can consider ETFs such as the iShares S&P 100 ETF (OEF), which holds 2.5% of its assets in Johnson & Johnson (JNJ), 1.6% in Pfizer (PFE), 1.4% in Merck & Co., and 0.7% in Bristol-Myers Squibb.