Analyzing the Correlation between Silver Prices and Miners

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals.

March 24 2017, Updated 10:37 a.m. ET

Miners’ correlations with precious metals

In this article, we’ll look at silver mining companies and their correlation to silver over the past three years. For those investors interested in parking their money in mining stocks, it’s crucial to understand which stocks are closely tied to precious metals and which aren’t. Stocks with higher correlations to precious metals will likely be even more affected by the global indicators that influence precious metals themselves.

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals. Echoing the precious metal’s rise since the start of the year, these two funds have risen 11.3% and 17.9%, respectively.

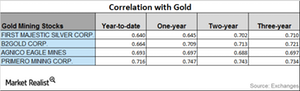

Now let’s take a look at the correlation of First Majestic Silver (AG), Silver Wheaton (SLW), Pan American Silver (PAAS), and Coeur Mining (CDE).

Correlation trends

Among these four miners, Pan American has the lowest correlation with silver, and Silver Wheaton has the highest correlation with silver.

Over the past three years, all the four miners have seen an upward trending correlation to silver. Studying upward and downward trends is important. Price change predictability can be affected as precious metal prices rise and fall.

Silver Wheaton’s correlation with silver has risen from a three-year correlation of ~0.66 to a one-year correlation of ~0.80. A correlation of ~0.80 means that ~80.0% of the time, Silver Wheaton has moved in the same direction as gold in the last year.