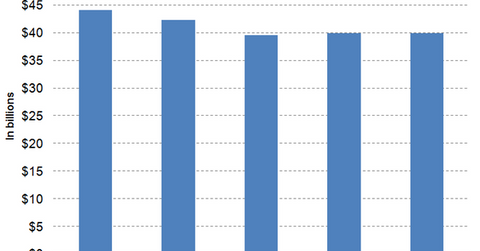

Merck Expects Modest Revenue Growth in Fiscal 2016

Merck provided revenue guidance of $39.7 billion–$40.2 billion in 2016. It expects negative foreign exchange fluctuations to reduce its fiscal 2016 revenue.

Dec. 4 2020, Updated 10:53 a.m. ET

Modest revenue growth

In its 3Q16 earnings transcript, Merck (MRK) provided revenue guidance of $39.7 billion–$40.2 billion in 2016. The company also expects that unfavorable foreign exchange fluctuations will reduce its fiscal 2016 revenues by ~2%. Non-GAAP EPS (earnings per share) will likely be $3.71–$3.78. Merck projects that the EPS will be impacted negatively due to foreign exchange fluctuations by ~1%. GAAP-based EPS is projected to be $2.02–$2.09 for fiscal 2016.

Merck projected that its non-GAAP gross margins in 2016 will also be similar to its gross margins in 2015. However, it expects that the gross margins will fall in 4Q16 on YoY (year-over-year) basis due to generic erosion of the revenues earned by Cubicin and Zetia in the US market. Merck also expects a fall in foreign exchange hedge gains on a YoY basis.

Merck estimated that including research and development tax credit, the company’s effective tax rate for fiscal 2016 will be closer to the higher end of 21.5%–22.5%.

Analysts’ projections

Wall Street analysts projected that Merck will earn revenue worth $39.9 billion in 2016. It will be YoY growth of ~1.1%. Analysts also estimated Merck’s 2016 EPS to be ~$3.78.

In 2016, peers such as Pfizer (PFE), Novartis (NVS), and Bristol-Myers Squibb (BMY) are expected to earn revenue of ~$52.9 billion, $48.8 billion, and $19.3 billion, respectively.

If Merck manages to surpass its 2016 revenue and EPS projections, it might have a positive impact on Merck’s share prices as well as the SPDR S&P 500 ETF (SPY). Merck accounts for ~0.85% of SPY’s total portfolio holdings.

In the next part, we’ll discuss the growth prospects of Keytruda—a leading oncology drug.