Gildan Activewear Acquires American Apparel for $66 Million

Gildan Activewear (GIL) reported fiscal 3Q16 net sales of $715.0 million, a rise of 6.0% compared to net sales of $674.5 million in fiscal 3Q15.

Nov. 16 2016, Updated 8:05 a.m. ET

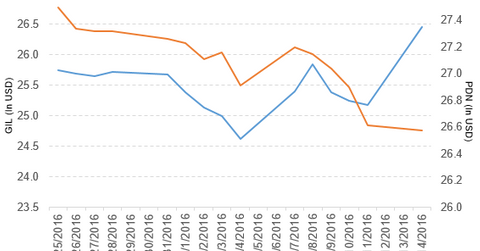

Price movement

Gildan Activewear (GIL) has a market cap of $6.3 billion. It rose 5.0% to close at $26.45 per share on November 14, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.1%, -2.4%, and -6.2%, respectively, on the same day.

GIL is trading 2.6% above its 20-day moving average, 2.7% below its 50-day moving average, and 7.1% below its 200-day moving average.

Related ETF and peers

The PowerShares FTSE RAFI Developed Markets Ex-US Small-Mid Portfolio ETF (PDN) invests 0.13% of its holdings in Gildan. The ETF tracks a fundamentally weighted index of small-cap and midcap developed-market securities outside the US. The YTD price movement of PDN was 2.5% on November 14.

The market caps of Gildan Activewear’s competitors are as follows:

Latest news on GIL

In a press release on November 14, 2016, Gildan Activewear reported, “Gildan Activwear Inc. (GIL) today announced that it has entered into an asset purchase agreement (APA) to acquire the worldwide intellectual property rights related to the American Apparel® brand and certain assets from American Apparel, LLC, (American Apparel), a US-based manufacturer of fashion basics, for a cash purchase price of approximately $66 million.

“Gildan will also separately purchase inventory from American Apparel to ensure a seamless supply of goods in the printwear channel while the Company integrates the brand within its Printwear business.”

The release also stated, “The closing of the transaction is subject to approvals by the American Apparel bankruptcy process and customary conditions, and is expected to occur during the first quarter of 2017.”

Performance of Gildan Activewear in fiscal 3Q16

Gildan Activewear (GIL) reported fiscal 3Q16 net sales of $715.0 million, a rise of 6.0% compared to net sales of $674.5 million in fiscal 3Q15. Sales from its Printwear and Branded Apparel segments rose 4.9% and 8.2%, respectively, in fiscal 3Q16 compared to fiscal 3Q15.

The company’s gross profit margin and operating margin narrowed by 100 basis points and 120 basis points, respectively, in fiscal 3Q16 compared to fiscal 3Q15.

Its net income and EPS (earnings per share) fell to $114.4 million and $0.49, respectively, in fiscal 3Q16 compared to $123.1 million and $0.50, respectively, in fiscal 3Q15. GIL reported adjusted EPS of $0.50 in fiscal 3Q16, a fall of 3.8% compared to fiscal 3Q15.

GIL’s inventories and accounts receivables rose 10.3% and 32.1%, respectively, in fiscal 3Q16 compared to fiscal 4Q15. It reported free cash flow of $184.9 million in fiscal 3Q16, a rise of 23.9% compared to fiscal 3Q15.

Quarterly dividend

Gildan Activewear (GIL) has declared a cash dividend of $0.078 per share on its common stock. The dividend will be paid on December 12, 2016, to shareholders of record on November 18, 2016.

Projections

Gildan Activewear has made the following projections for fiscal 2016:

- adjusted EPS: $1.48–$1.50

- adjusted EBITDA: ~$530 million–$535 million

- consolidated net sales: ~$2.6 billion, which reflects projected sales of ~$1.7 billion and ~$960 million from its Printwear and Branded Apparel segments, respectively.

Next, we’ll discuss BorgWarner (BWA).