Gildan Activewear Inc

Latest Gildan Activewear Inc News and Updates

Gildan Activewear Acquires American Apparel for $66 Million

Gildan Activewear (GIL) reported fiscal 3Q16 net sales of $715.0 million, a rise of 6.0% compared to net sales of $674.5 million in fiscal 3Q15.

Gildan Activewear Declares Its 2Q16 Results and Dividend

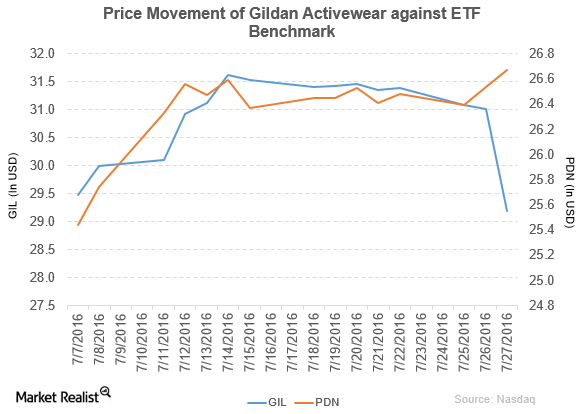

Gildan Activewear (GIL) has a market cap of $6.9 billion. It fell by 5.9% to close at $29.19 per share on July 27, 2016.