Borg Warner Inc

Latest Borg Warner Inc News and Updates

How Has Lear Performed Compared to Its Peers?

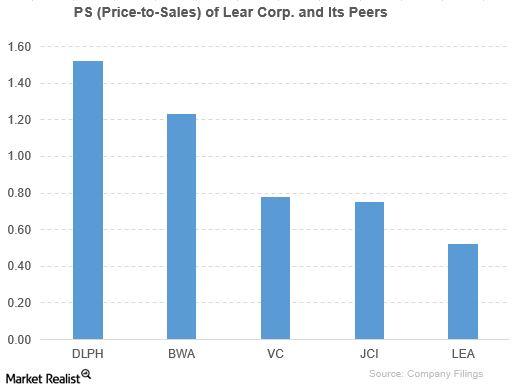

Competitors have outperformed Lear based on PE and PS. However, Lear is way ahead of its peers based on PBV. Lear is way ahead of its ETFs based on price movement.

BorgWarner Announces the Appointment of Investor Relations VP

BorgWarner (BWA) reported 3Q16 net sales of $2.2 billion, a rise of 15.8% over the net sales of $1.9 billion in 3Q15.

How Has BorgWarner Been Doing?

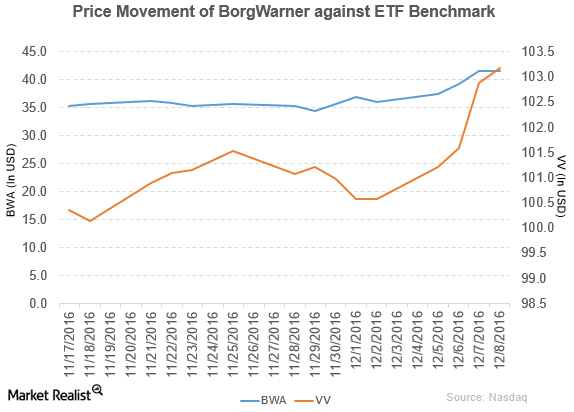

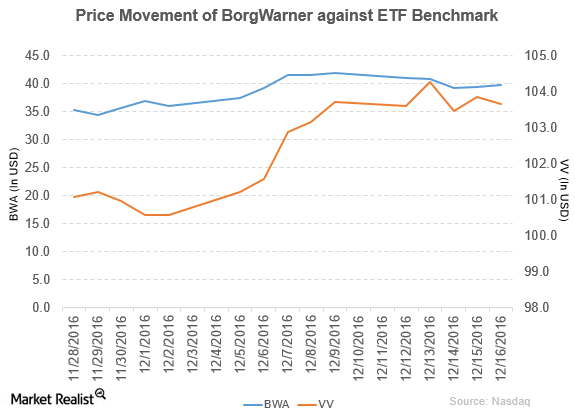

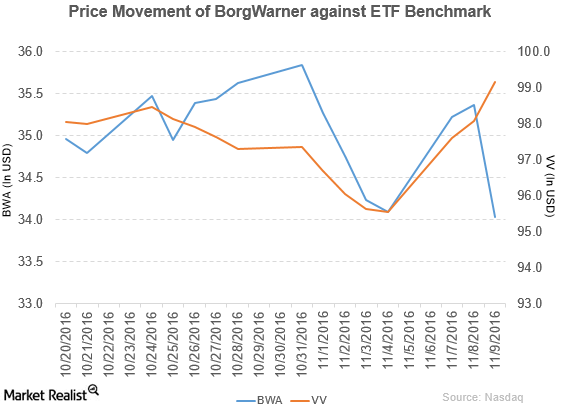

Price movement BorgWarner (BWA) has a market cap of $9.1 billion. It rose 0.07% to close at $41.63 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 13.0%, 18.2%, and -2.2%, respectively, on the same day. BWA is trading 16.3% above its 20-day moving average, 18.0% above […]

Wells Fargo Downgrades BorgWarner to ‘Market Perform’

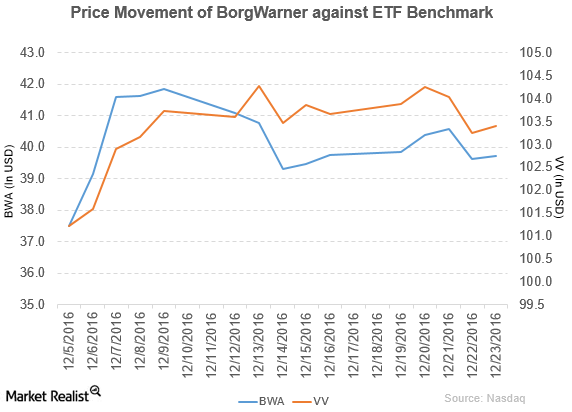

BorgWarner (BWA) fell 0.03% to close at $39.73 per share during the third week of December 2016.

Northcoast Downgrades BorgWarner to ‘Neutral’

Price movement BorgWarner (BWA) fell 5.1% to close at $39.74 per share during the second week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -5.1%, 15.7%, and -6.6%, respectively, as of December 16. BWA is trading 5.4% above its 20-day moving average, 10.5% above its 50-day moving average, and […]

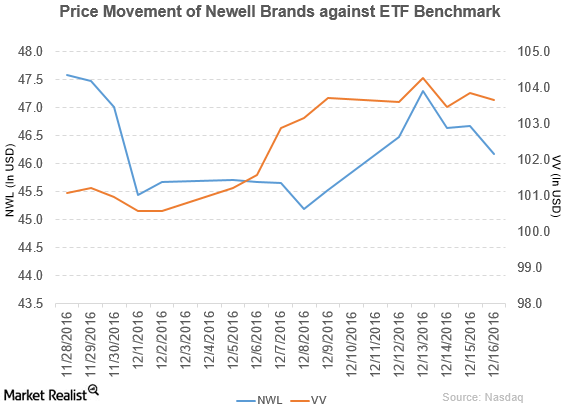

Newell Brands Announces Its New Acquisition Plans

Price movement Newell Brands (NWL) rose 1.4% to close at $46.18 per share during the second week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.4%, -1.2%, and 6.5%, respectively, as of December 16. NWL is trading 1.1% below its 20-day moving average, 5.0% below its 50-day moving average, […]

Jefferies Rated BorgWarner as a ‘Buy’

BorgWarner declared a quarterly cash dividend of $0.14 per share on its common stock. The dividend will be paid on December 15, 2016, to shareholders of record on December 1, 2016.

Berenberg Rated BorgWarner as a ‘Sell’

On November 22, 2016, Berenberg has initiated the coverage of BorgWarner (BWA) with a “sell” rating and also set the stock’s price target at $28.00 per share.

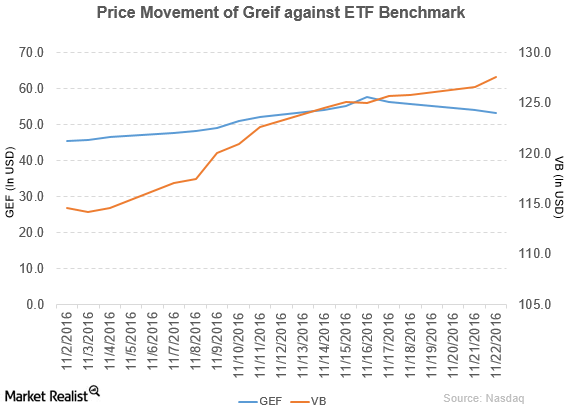

Bank of America/Merrill Lynch Downgrades Greif to ‘Neutral’

Greif reported 3Q16 net sales of $845.0 million, a fall of 9.1% compared to its net sales of $930.0 million in 3Q15.

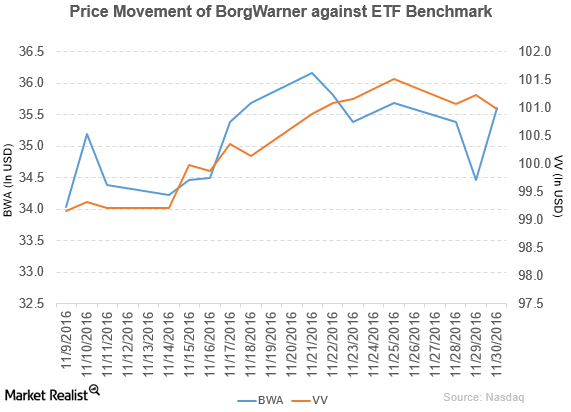

BorgWarner Announces the Launch of Its Electric Drive Module

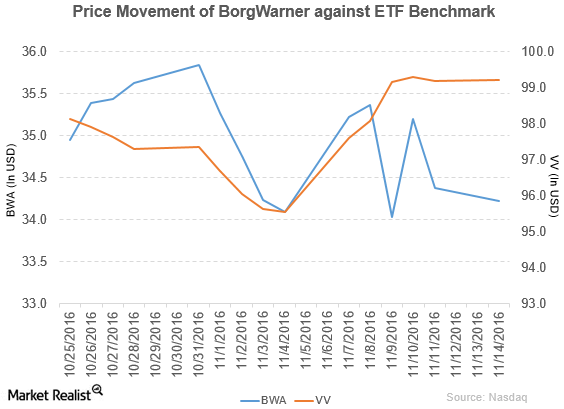

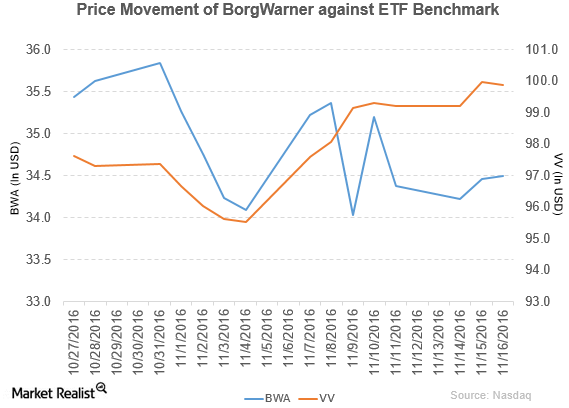

BorgWarner (BWA) has a market cap of $7.3 billion. It rose 0.09% to close at $34.49 per share on November 16, 2016.

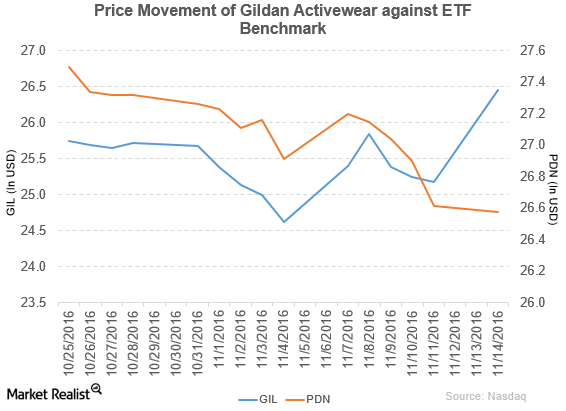

Gildan Activewear Acquires American Apparel for $66 Million

Gildan Activewear (GIL) reported fiscal 3Q16 net sales of $715.0 million, a rise of 6.0% compared to net sales of $674.5 million in fiscal 3Q15.

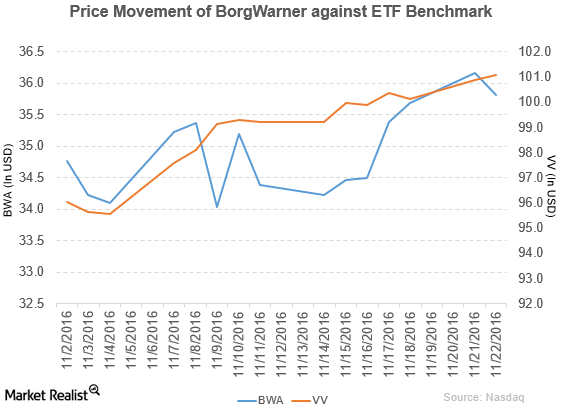

BorgWarner Declares Dividend of $0.14 Per Share

Price movement BorgWarner (BWA) has a market cap of $7.4 billion. It fell 3.8% to close at $34.03 per share on November 9, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.1%, -4.3%, and -21.3%, respectively, on the same day. BWA is trading 2.6% below its 20-day moving average, 2.8% below […]