Why Did Analysts Fall Out of Love with Southwest Airlines?

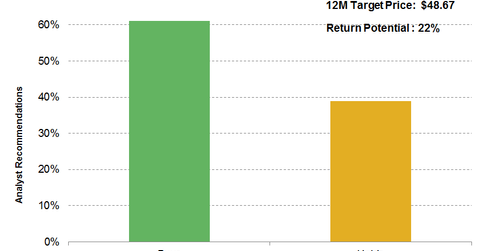

Out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16.

Dec. 4 2020, Updated 10:53 a.m. ET

Analyst views

Analysts’ recommendations or changes to recommendations can have a significant impact on a stock’s price. Changes may also indicate a shift in the long-term trend.

According to a Bloomberg consensus, out of the 18 analysts tracking Southwest Airlines (LUV), 11 analysts (61.1%) have a “buy” recommendation on the stock versus 71% analysts that had a “buy” recommendation on Southwest in 2Q16. Seven analysts (38.9%) have a “hold” rating, and none of the analysts have a “sell” rating on the stock.

Target price

Southwest’s consensus 12-month target price is $48.67 versus $53.54 at the end of 2Q16. The current target price indicates an ~22% return potential on October 11, 2016. Hunter Keay from Wolfe Research reiterated his “outperform” rating on the stock and reduced his target price from $62.00 to $56.00.

Julie Yates from Credit Suisse has an “outperform” rating with a target price of $52.00. J.P. Morgan’s Jamie N. Baker has a “neutral” rating with a $32.50 target price, which is the lowest among all analysts. Daniel McKenzie from Buckingham Research also has a “neutral” rating with a $40.00 price target.

Investors can gain exposure to airlines through the iShares Transportation Average ETF (IYT). IYT holds 4.2% in Alaska (ALK), 3.9% in United Continental (UAL), 3.8% in Southwest Airlines (LUV), 3.6% in Delta Air Lines (DAL), 2.8% in American Airlines (AAL), and 1.7% in JetBlue Airways (JBLU).

Analyst estimates

For 2016, analysts estimate Southwest Airlines’s (LUV) sales to grow 3.1% to $20.4 billion, lower than the 2015 growth of 6.5%. LUV’s EBITDA[1. earnings before interest, tax, depreciation, and amortization] is expected to rise 4% to $5.2 billion and its earnings per share are expected to rise 7% to $3.78.

In the next few articles, we’ll discuss what led to these estimates, helping investors judge whether analysts are being optimistic or conservative on the stock. We’ll also help you understand what may be priced into the stock.