Should You Short European Bonds due to Taper Talks?

Like their equity peers, bonds can be short-sold as well. You can do it by either shorting an ETF or investing in an inverse ETF.

Oct. 7 2016, Published 4:49 p.m. ET

Short-selling bonds

Like their equity peers, bonds can be short-sold as well. You can do it by either shorting an ETF or investing in an inverse ETF, apart from investing in futures and options products. As far as US bonds, inverse ETFs like the Direxion Daily 20+ Year Treasury Bear 3x Shares (TMV) and the ProShares Short 20+ Year Treasury ETF (TBF) are particularly popular with investors wanting to go short on bonds. The leveraged ETF ProShares UltraShort 20+ Year Treasury (TBT) is also used for this purpose.

On the other hand, like any equity investment, you can short ETFs like the SPDR Barclays International Treasury Bond ETF (BWX) and the iShares International Treasury Bond ETF (IGOV). Or like Bill Gross, you can move to shorter duration European bonds.

But should you short bonds?

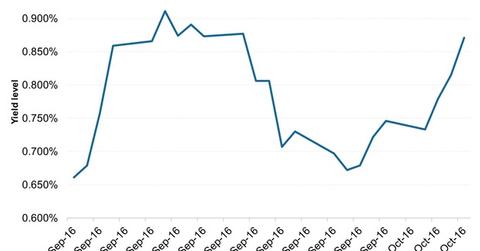

At this juncture, it could be more prudent to move to shorter duration European bonds rather than shorting them. The reason is that the economic conditions don’t look primed for a taper. Even though the current bond-buying program is expected to end in March 2017, there is a very high probability that it will be extended. The fallout from Brexit on Britain’s (EWU) and Europe’s economies and related instruments (EZU) likely won’t be insignificant. UK’s gilts have reacted sharply as well, as shown in the graph above. Thus, scaling back stimulus doesn’t seem likely given that the ECB’s (European Central Bank) inflation target of 1.6% would continue to remain under pressure.

However, investors should monitor tapering developments. Monetary stimulus, like youth, can’t go on forever, and it is a wise strategy to prepare for a removal of monetary support. For the ECB, vocal talks about possible tapering would indicate one of two things:

- Its inflation target is in sight.

- It needs more support from fiscal policies, as monetary policy has run its course.

Investors would be wise to stay up-to-date on the fallout of Brexit and eventual tapering, but a reaction at this juncture is likely not warranted.