Iron Ore Shipments Remain Strong for August

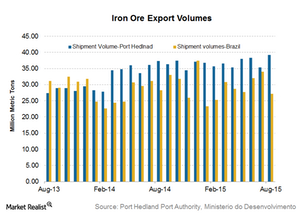

Iron ore shipments through Port Hedland reached an all-time high of 39.2 million tons in August as compared to 35.3 million tons in July.

Sept. 22 2015, Updated 10:06 p.m. ET

Port Hedland iron ore shipments

Port Hedland iron ore exports are a key supply side indicator to watch for iron ore investors. This is the port where the bulk of Australian iron ore leaves for China and other destinations. Major iron ore players such as BHP Billiton (BHP) (BBL), Fortescue Metals Group (FSUGY), Atlas Iron, and Rio Tinto (RIO) ship iron ore out of Cape Lambert and Dampier.

Shipments through Port Hedland reached an all-time high of 39.2 million tons in August as compared to 35.3 million tons in July and 37.4 million tons a year ago. Shipments to China also increased by 15% month-over-month to 33.9 million tons. Part of this surge may be due to the fact that volumes were lower in July due to the scheduled maintenance activities.

Brazil iron ore exports

Brazil accounts for about 25% of the global market share of iron ore’s trade volume. Vale SA (VALE) is the major iron ore producer in Brazil. Brazil iron ore shipments in August fell by 20.5% month-over-month to 27.1 million tons. For the first eight months of the year, however, the shipments have increased by 6% year-over-year.

Shipment volumes from Australia and Brazil were lower than expected in the past few months due to scheduled maintenance activities and erratic weather. Weaker shipments coupled with restocking in China helped iron ore prices rebound from an almost six-year low value of $44.6 per ton at the beginning of July. However, going forward, the shipments should be supported from expansion plans from majors such as BHP, RIO, and VALE. This will continue to keep the supply side strong, which should be negative for iron ore prices in the event of continuing weaker demand.

Unabsorbed supply in the form of lower iron ore prices is already hurting iron ore players such as Cliffs Natural Resources (CLF). It also negatively impacts the iShares MSCI Global Metals & Mining Producers ETF (PICK). BHP Billiton accounts for 17.9% of PICK’s holdings. The SPDR S&P Metals & Mining ETF (XME) also invests in some of these stocks.

In the next part of this series, we’ll see how the Chinese iron ore inventory at various ports is shaping up amid higher shipments.