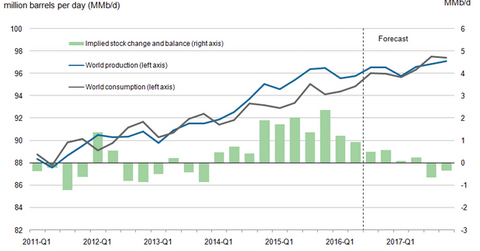

Global Crude Oil Supply and Demand Could Balance in 2017

The EIA estimates that the global crude oil supply could outstrip demand by 1.1 MMbpd (million barrels per day) in 2H16—compared to 2.2 MMbpd in 1H16.

Nov. 20 2020, Updated 5:24 p.m. ET

Crude oil prices

NYMEX October WTI (West Texas Intermediate) crude oil futures contracts rose 0.3% and were trading at $43.7 per barrel in electronic trading at 5:10 AM EST on September 14, 2016. Prices rose following the sharp fall the previous day.

Prices rose in August and so far in September 2016 due to speculation about oil producers’ meeting—it could result in an output cap. Read How Will Traders Play the Major Oil Producers’ Meeting? to learn more.

However, crude oil prices have fallen 8% in the last five trading sessions due to expectations of strengthening crude oil supplies.

Supply and demand balance

The possibility of increasing crude supplies from Libya and Nigeria will add to the oversupplied crude oil market.

The EIA (U.S. Energy Information Administration) estimates that the global crude oil supply could outstrip demand by 1.1 MMbpd (million barrels per day) in 2H16—compared to 2.2 MMbpd in 1H16. It expects that the crude oil supply and demand will reach a balance in 2017.

The IEA (International Energy Agency) reported that slowing crude oil demand, high global crude oil and product inventories, and rising crude oil production will extend the crude oil oversupply until 1H17. The IEA revised the crude oil demand growth for 2016 to 1.3 MMbpd in 2016—100,000 bpd less than the previous estimates.

OPEC (Organization of the Petroleum Exporting Countries) reported that countries like the US, Russia, and Norway could produce 190,000 bpd (barrels per day) more in 2016—compared to the previous estimates.

Changes in demand and supply estimates can cause volatility in crude oil prices. Read US Crude Oil Reached These Highs and Lows in 2016 for more on US crude oil prices’ highs and lows.

Crude oil prices could feel the heat due to glut in refined products, easing supply outages, as well as high OPEC and Russian crude oil production. For more on refined products inventories, read Part 8 and Part 10 in this series.

Lower crude oil prices have a negative impact on oil producers’ profitability such as SM Energy (SM), Sanchez Energy (SN), and Goodrich Petroleum (GDP).

They also impact funds such as the VelocityShares 3x Inverse Crude Oil ET N (DWTI), the PowerShares DWA Energy Momentum ETF (PXI), the United States Oil ETF (USO), and the ProShares Ultra Bloomberg Crude Oil ETF (UCO).

In the next part of this series, we’ll look at US crude oil inventories.