The Evolution of REITs

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion.

Sept. 20 2016, Updated 3:04 p.m. ET

The Evolution of REITs

The basic concept of REITs originated with the business trusts that were formed in Massachusetts in the mid-19th century, when the wealth created by the industrial revolution led to a demand for real estate investment. The first REIT was set up in 1961, but it took several decades before REITs were fully accepted as a viable asset class.

The foundation for the modern REIT market was laid in the 1980s, when the U.S. real estate market boomed and subsequently went bust. Overbuilding coupled with a reversal of a key tax shelter led to a decline in property values during the second half of the decade.

The decline in property values was a blessing in disguise for REITs, as it allowed them to acquire properties at very cheap prices and served to buoy subsequent REIT performance. Between 1991 and 1993, the S&P U.S. REIT Index generated an average annualized return of approximately 20%.

As demand for their shares began to rise, many REITs transformed themselves from private entities to public companies in order to take advantage of attractive valuations. In fact, some of the largest REITs went public during this time (e.g., Duke Realty, Kimco Property and Simon Property Group). By 1994, the estimated market capitalization of the U.S. REIT market had reached approximately USD 44 billion, almost six times its size in 1990. REITs have evolved into a mature asset class, with more than USD 938 billion in market capitalization.

Moreover, the breadth of the REIT market has increased to include the 12 property sectors currently available to REIT investors. Newer sectors include residential properties (e.g., manufactured homes), industrial properties, self-storage properties and hotels.

Since the IPO boom of the mid-1990s, the REIT market has continued to gain acceptance among investors. Evidence of this can be seen by looking at the increased number of REITs in the S&P 500.

Globally, the property market has continued to evolve. While the U.S. still has the largest property market as measured by the market capitalization of public property companies, Japan, Australia, the U.K., France, and Hong Kong also have sizable market. Increased international representation could bode well for real estate investors, as the wider opportunity set may provide more chances for diversification.

Market Realist’s View

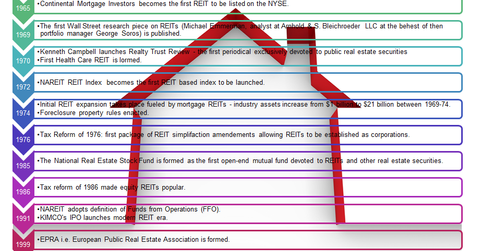

The graph above provides a snapshot of REITs’ (RWR)(VNQ) evolution over the years. As of August 31, 2016, there were 189 REITs (ICF)(FRI) listed on the New York Stock Exchange with a whopping combined market capitalization of $986 billion. [1. Source: NAREIT]

The REITs (IYR) sector has shown phenomenal growth over the years. In the past five decades, REITs have grown to a market cap of nearly $1 trillion while holding real estate assets of a massive $2 trillion. More than 35 countries have adopted the REIT approach since the United States pioneered the asset class in the 1960s—as you can see in the graph above.

We’ll discuss the benefits of investing in REITs in the next parts of this series.