Altria Group Reaffirms Its 2016 Projections

Altria Group (MO) has a market cap of $130.4 billion. It fell by 0.71% to close at $66.72 per share on September 7, 2016.

Sept. 9 2016, Updated 10:05 a.m. ET

Price movement

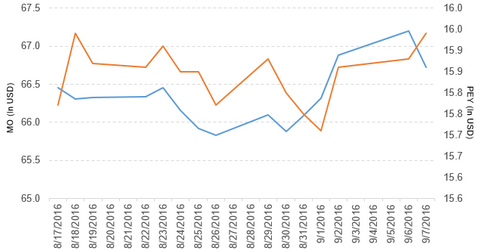

Altria Group (MO) has a market cap of $130.4 billion. It fell by 0.71% to close at $66.72 per share on September 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.3%, 0.35%, and 16.7%, respectively, on the same day.

MO is trading 0.5% above its 20-day moving average, 1.3% below its 50-day moving average, and 7.2% above its 200-day moving average.

Related ETF and peers

The PowerShares High Yield Equity Dividend Achievers Portfolio ETF (PEY) invests 2.1% of its holdings in Altria Group. The ETF aims to track a yield-weighted index of US companies that have increased their annual dividend for at least ten consecutive years. The YTD price movement of PEY was 22.2% on September 7.

The market caps of Altria Group’s competitors are as follows:

Performance of Altria Group in 2Q16

Altria Group reported 2Q16 net revenue of $6.5 billion, a fall of 1.5% from the net revenues of $6.6 billion in 2Q15. The net revenue from smokable products fell by 3.3%, and net revenue from smokeless products and wine rose by 8.7% and 6.2%, respectively, between 2Q15–2Q16.

The company’s gross profit margin and operating income rose by 5.0% and 9.1%, respectively. It reported a gain on the derivative financial instrument of $117.0 million in 2Q16.

Its net income and EPS (earnings per share) rose to $1.7 billion and $0.84, respectively, in 2Q16, compared with $1.4 billion and $0.74, respectively, in 2Q15. It reported adjusted EPS of $0.81 in 2Q16, a rise of 9.5% from 2Q15.

Altria’s cash and cash equivalents and inventories fell by 65.4% and 3.0%, respectively, between 4Q15–2Q16. Its debt-to-equity ratio fell to 4.1x in 2Q16, compared with 4.5x in 4Q15.

During 2Q16, the company repurchased 2.7 million shares worth $173 million at an average price of $64.06 per share. On June 30, 2016, it has ~$624 million shares remaining under its current share repurchase program.

Quarterly dividend

Altria Group has declared a regular quarterly dividend of $0.61 per share, an increase of 8.0%, on its common stock. The dividend will be paid on October 11, 2016, to shareholders of record on September 15, 2016.

Projection

Altria Group (MO) has reaffirmed the following projections for fiscal 2016 at the Barclays Global Consumer Staples Conference:

- adjusted EPS in the range of $3.01–$3.07, which does not include the impact from the Anheuser-Busch InBev-SABMiller business combination

- effective tax rate of ~35.3%

In the next part of this series, we’ll discuss Sony Corporation (SNE).