How Much Lower Can BHP Billiton Push Its Costs in Iron Ore?

BHP’s total iron ore production increased by 2% in fiscal 2016 to a record 227 million tons.

Aug. 18 2016, Published 11:43 a.m. ET

Iron ore costs

Iron ore makes up 34% of BHP Billiton’s (BHP) (BBL) revenues and 45% of its EBITDA (earnings before interest, tax, depreciation, and amortization). So it’s important to look at its iron ore costs, which determine its iron ore segment’s profitability. This ultimately impacts its stock price and performance.

Cost-cutting in iron ore

- BHP’s total iron ore production increased by 2% in fiscal 2016 to a record 227 million tons.

- More than 90% of BHP’s iron ore comes from WAIO (Western Australia iron ore). The production of WAIO increased by 2% to a record 257 million tons on a 100% basis, mainly due to the Jimblebar mine operating at full capacity and improved plant utilization at Newman.

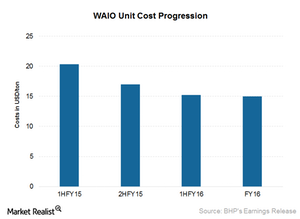

- Unit costs for BHP’s WAIO fell 19% to $15 per ton in fiscal 2016. This is in line with the company’s fiscal 2016 cost guidance.

- Cost reduction was driven by lower labor and contractor costs, increased equipment productivity, lower diesel prices, and a stronger US dollar (UUP) (USDU).

- Increased volumes and lower costs led to an EBITDA margin of 53%. This is despite a fall in average realized iron ore prices during the period.

Further cost reduction

- For fiscal 2016, BHP management expects unit costs to decline 7% more to $14 per ton. This is based on the exchange rate assumption of the Australian dollar and the US dollar of 0.71.

- In comparison, Rio Tinto’s (RIO) unit cash costs at its Pilbara mines came in at $14.30 per ton in the half-year ended June 30, 2016. It was a decline of 12% year-over-year. Vale SA (VALE) is expecting to become the cost leader on FOB (free on board) after its ambitious S11D project comes online. Cliffs Natural Resources (CLF) also reduced its production costs in the United States due to a headcount reduction and other input costs.

Management also commented on its decision not to replace Yandi when its mine life ends if price pressures in the iron ore space remain. It said it’s very close to the bottom of the cost curve. Even in the case of reduced Chinese demand, the company still has a large opportunity to earn high margins with its iron ore segment. BHP also remains constructive on the demand potential from India and other Southeast Asian countries.

In a commoditized space such as iron ore mining, miners can’t control prices. Controlling costs in such a scenario could be a key differentiator between companies and could lead to a stock price performance divergence.

BHP Billiton, Rio Tinto, and Vale form 32.1% of the iShares MSCI Global Metals & Mining Producers ETF (PICK). The SPDR S&P Metals and Mining ETF (XME) also provides exposure to this space.

In the next part, we’ll see what BHP is doing to survive in the depressing state of affairs for the coal market.