Integrated Energy and Refiner Stocks That Lead in Short Interest

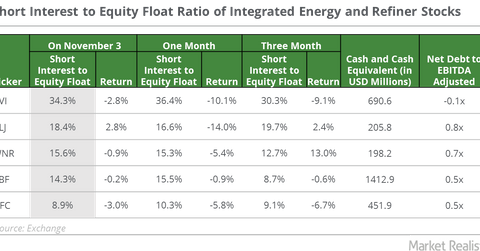

As of November 3, 2016, CVR Energy (CVI) had the highest short interest-to-equity float ratio among our list of integrated energy and refiner stocks.

Nov. 20 2020, Updated 11:02 a.m. ET

CVR Energy

As of November 3, 2016, CVR Energy (CVI) had the highest short interest-to-equity float ratio among our list of integrated energy and refiner stocks. Its ratio is 34.3%. One month ago, it was 36.4%. Three months ago, it was 30.3%.

In the past three months, CVR Energy’s stock fell 9.1%. Its short interest-to-equity float ratio rose 13% during the same period.

CVR Energy’s net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) is -0.1x because it has cash in excess of debt. Its cash and cash equivalents were $690.6 million in 2Q16.

CVR Energy is the holding company of the high volatility refining partnership CVR Refining LP (CVRR) that we discussed in Part 1.

Alon USA

Alon USA Energy’s (ALJ) short interest-to-equity float ratio is 18.4%. One month ago, it was 16.61%. Three months ago, it was 19.7%. During this period, the stock rose 2.4%. The short interest-to-equity float ratio fell 6.3% during this period.

The company’s net-debt-to-EBITDA ratio is 0.8x and its cash and cash equivalents were $205.8 million as of 2Q16. Alon USA Energy is one of the high implied volatility stocks we discussed in Part 1 of this series. Alon USA Energy is also the general partner and majority interest holder in another high volatility refining partnership we discussed earlier—Alon USA Partners (ALDW).

Western Refining

Western Refining’s (WNR) short interest-to-equity float ratio is 15.6%. One month ago, it was 15.3%. Three months ago, it was 12.7%. Its net debt-to-EBITDA ratio is 0.7x and its cash and cash equivalents were $198.2 million in 2Q16. In the past three months, the stock has returned 13%. The stock’s short interest rose 22.8%.

PBF Energy

Currently, PBF Energy’s (PBF) short interest-to-equity float ratio is 14.3%. One month ago, it was 15.5%. Three months ago, it was 8.7%.

In the past three months, PBF Energy’s stock has fallen 0.6%, while the short interest-to-equity float ratio rose 64.3% during the same period. Its net debt-to-EBITDA ratio was 0.5x in 1Q16 and its cash and cash equivalents were $1.4 billion.

HollyFrontier

HollyFrontier’s (HFC) short interest-to-equity float ratio is 8.9%. One month ago, it was 10.3%. Three months ago it was 9.1%. Its net debt-to-EBITDA ratio is 0.5x and its cash and cash equivalents were $451.9 million in 2Q16.

In the past three months, the stock has fallen 6.7%. The short interest-to-equity float ratio fell 1.5%.

Tesoro (TSO) and Valero Energy (VLO) have short interest-to-equity float ratios of 3.8% and 4.8%, respectively.

Conclusion

From the above analysis, we can make the following observations:

- There’s an inverse relationship between returns and short interest. In most cases, stocks that witnessed a rise in short interest also saw a fall in their stocks.

- Traders and investors are more bearish on refiner stocks than on integrated energy stocks. It shows markets’ bearish outlook on the uncertain US refining environment.

- All of the companies leading in short interest are relatively smaller refiners with less diversification in their operations. It could reduce their ability to withstand volatility in the refining environment.

- Markets are less bearish on larger and more diversified integrated energy companies. They also figure among the low volatility stocks, as we saw in Part 1 of this series.