It Was a Festive Holiday Season for Signet Jewelers

On January 7, 2016, Signet Jewelers (SIG), the world’s largest retailer of diamond jewelry, announced its broad-based success in the holiday season with revenue of $1.9 billion.

Dec. 4 2020, Updated 10:53 a.m. ET

Signet’s holiday season sales

On January 7, 2016, Signet Jewelers (SIG), the world’s largest retailer of diamond jewelry, announced its broad-based success in the holiday season. For the eight weeks of the holiday season that ended December 26, 2015, Signet reported revenue of $1.9 billion. That was an increase of 5% over the prior year’s holiday season. On a constant-currency basis, sales increased 6.3%.

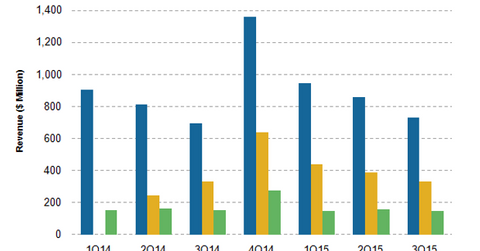

Let’s look now at the divisions of Signet Jewelers.

- Sterling Jewelers, which operates in the United States, accounted for 61.4% of Signet’s total holiday sales. Sterling Jewelers sales increased 7.2% compared to the prior year, driven by the Kay and Jared brands.

- The Zale division accounted for 27.4% of Signet’s total holiday sales. Zale reported an increase of 2.3% in holiday season sales, mainly driven by Piercing Pagoda. On a constant-currency basis, Zale’s sales improved by 5%.

- The UK division represented 11.1% of Signet’s holiday sales. The division’s holiday sales were almost flat compared to the prior year. On a constant-currency basis, sales increased 4.9%.

What impacted the revenue?

- Strategic initiatives taken by the company included superior customer service, exciting new product launches, continued success of existing collections, and improved advertising trade.

- Signet’s strategic objective to be the best in bridal ended up in a strong performance during the holiday season throughout all selling channels and geographic regions.

- Diamond earrings continued to drive sales.

- A number of fashion diamond collections performed well. Fashion collections, especially jewelry for the wrist such as bracelets, charms, and watches, saw strong growth.

- For Zale, initiatives such as employee training and newly designed kiosks helped generate strong results at Piercing Pagoda, where sales increased 9% over the previous year.

- Store operation improvements, exclusive merchandise programs, and new marketing initiatives helped Jared improve its sales by 6.8% in the holiday season.

Peer group comparison

In 3Q15, Signet’s peers in the jewelry industry included Tiffany (TIF) and Fossil Group (FOSL), whose sales fell 4% and 5%, respectively, due to the strong US dollar. In comparison, Signet’s sales increased by 3.3% in 3Q15, which ended October 31, 2015. For Tiffany and Fossil, 3Q15 ended on October 31, 2015, and October 3, 2015, respectively.

Signet is a component of the S&P 500 Index (SPY) and part of the SPDR S&P Retail ETF (XRT). It has a weight of ~1% in XRT. Specialty retail companies make up 19.4% of XRT’s portfolio.

To know more about Signet Jewelers, you can read the Market Realist series An Investor’s Guide to Signet Jewelers, a Jewelry Giant.