Operating Margins for Upstream Companies Rose

The operating margin of the US-based (SPY) upstream companies rose by an average of 16%.

Jan. 5 2016, Updated 6:06 p.m. ET

Operating margin

The operating margin of the US-based (SPY) upstream companies rose by an average of 16%. The operating margin of ConocoPhillips and EOG Resources stood at 13% and 26%, respectively. The operating margin of Apache (APA) and COG stood at -22% and 2%, respectively. The metric is an important indicator of the financial health of a company.

Operating margin refers to the operating profit margin of a company. The operating margin of ConocoPhillips, Marathon Oil (MRO), and COG were at 17%, 14%, and 9%, respectively.

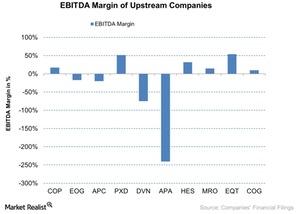

EBITDA margin

The EBITDA (earning before interest, taxes, depreciation, and amortization) margin of the above upstream companies in 3Q15 stood at -17%. It coincides with the lower crude oil prices and natural gas prices. The falling price of natural gas and crude oil is affecting the EBITDA margin of crude oil. Since mid-November crude oil has fallen more than 60%.

The EBITDA margin for Devon Energy (DVN) and Apache (APA) fell by 75% and 250% in 3Q15. The EBITDA margin for Pioneer Natural Resources (PXD) and EQT (EQT) were at 51% and 31%, respectively. The graph above shows the EBITDA margin for upstream companies. The EBITDA margin is calculated by dividing EBITDA from sales.

In the next part, we will discuss the seasonality of crude oil inventory, which is often misunderstood by upstream investors.