How Long Can the Price War Continue in Crude Oil?

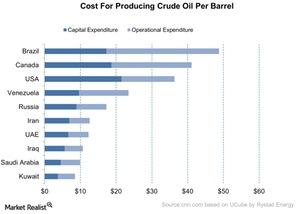

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia.

Dec. 17 2015, Updated 9:05 a.m. ET

Break-even cost for top oil exporters

According to data compiled by Rystad Energy, the cost of production per barrel of crude oil is $17.20 in Russia—compared to $9.90 in Saudi Arabia. Saudi Arabia accounts for 15.7% of the world’s total crude oil reserve. Russia (RSX) accounts for 6.1% of the world’s total crude oil reserve. However, there are other reserves in the Arctic Circle. This can increase its share in the total crude oil reserve.

Venezuela accounted for 17.5% of the world’s total proved crude oil reserve in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

The other member countries like Iran and Iraq have break-even costs of $12.60 and $10.60. Kuwait has the lowest production cost of ~$8.50. It takes a break-even cost of $12.30 in the UAE (United Arab Emirates) to produce one barrel of crude. Gazprom PAO (OGZPY), Lukoil (LUKOY), and Tatneft (OAOFY) represent the large-cap Russian ADRs (American depositary receipts) in the oil and gas sector. The above chart shows the break-even cost for different countries.

Break-even cost for other countries

The data suggest that the cost to produce a barrel of crude oil in the US (SPY) is $36.20. In Canada, it costs $41 to produce a barrel of crude oil. Imperial Oil (IMO) and Suncor Energy (SU) are Canada-based integrated oil and gas companies.

In the next part, we’ll discuss the impact of Russia’s presence in the Middle East. We’ll see how it impacts the crude oil market.