How the Late October Oil Rig Count Dip Hurt the Total US Rig Count

By October 30, 2015, the total US rig count fell by 16 crude oil rigs. The number of crude oil rigs has continued to fall in the past nine weeks.

Nov. 2 2015, Published 3:14 p.m. ET

US oil and gas rig counts

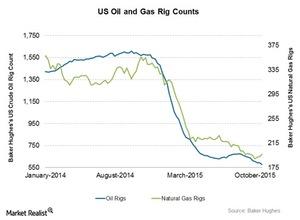

According to Baker Hughes (BHI), in the week ending October 30, 2015, the total US rig count fell by 16 crude oil rigs, while four natural gas rigs were added to the count. The number of crude oil rigs has continued to fall in the past nine weeks. The natural gas rig count has been volatile, but seems to be trending upwards.

Total US rig count change

In the 12 months ending October 30, 2015, the total US crude oil and natural gas rig count fell by 1,154, or 60%. The number of active oil rigs fell by 1,004, or 63%. The number of natural gas rigs fell by 149, or ~43%, over this period.

Why rig count trends matter

Rig counts tell us how many rigs are actively drilling for oil and gas. Analyzing the change in the number of active rigs can help us understand how long-term supply could evolve. Oil and gas rig counts signal how confident producers are about drilling for oil and gas.

Rising rig counts could indicate a potential rise in supplies in the months to come. In contrast, falling rig counts point to a potential stagnation in supplies.

Effect on energy companies

The 60% fall in active rigs over the past year indicates a fall in exploration and production activity by upstream oil and gas companies. Falling natural gas rig counts over the past year would negatively affect providers of natural gas compression services such as Exterran Holdings (EXH) and Exterran Partners (EXLP).

The falling trend over the past year would also have a negative impact on Nabors Industries (NBR), since it provides drilling and rig services as well as completion and production services. Drill equipment makers such as Schlumberger (SLB) and Halliburton Company (HAL) could also suffer if rig counts fall. Schlumberger forms 20.4% of the VanEck Vectors Oil Services ETF (OIH).

At the same time, a lower rig count should reduce oil field services companies’ revenues as upstream companies reduce exploration and production activity, pushing oil field service companies to take lower contract terms or day rates to save on costs.

Lower crude oil and natural gas production could also negatively affect midstream energy MLPs such as Williams Partners (WPZ), Energy Transfer Partners (ETP), MarkWest Energy Partners (MWE), and Enbridge Energy Partners (EEP) due to lower volumes.

In the next part of this series, we’ll take a deeper look into the impact of lower rig counts in October 2015.