Nabors Industries Ltd

Latest Nabors Industries Ltd News and Updates

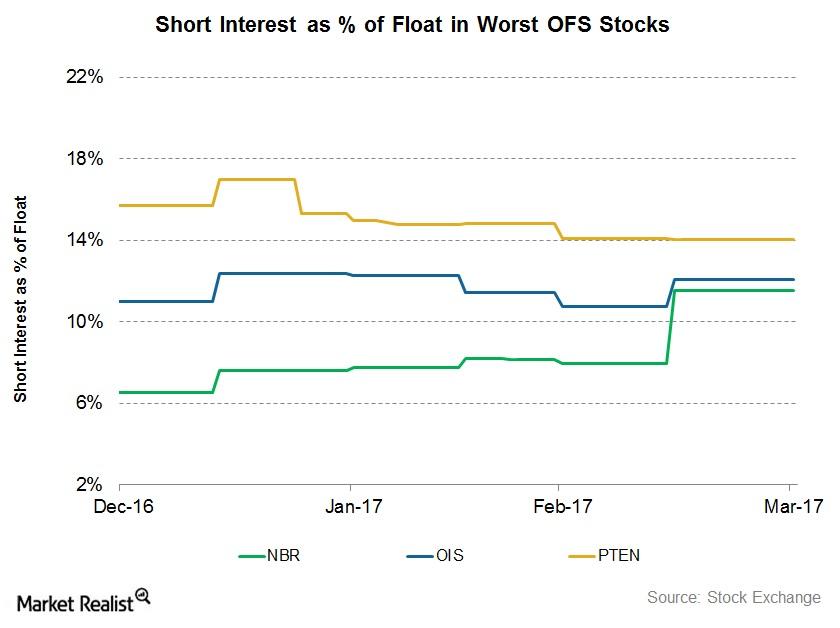

What’s Nabors Industries’ Short Interest as of June 19?

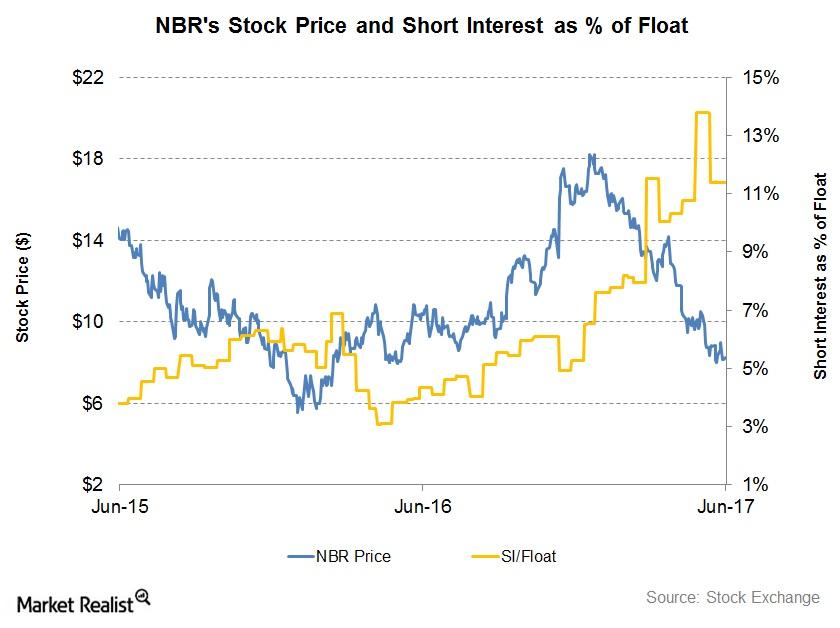

Short interest in Nabors Industries (NBR) as a percentage of its float was 11.4% as of June 19, 2017, compared to 10.1% as of March 31, 2017.

What Nabors Industries’ Historical Valuation Suggests

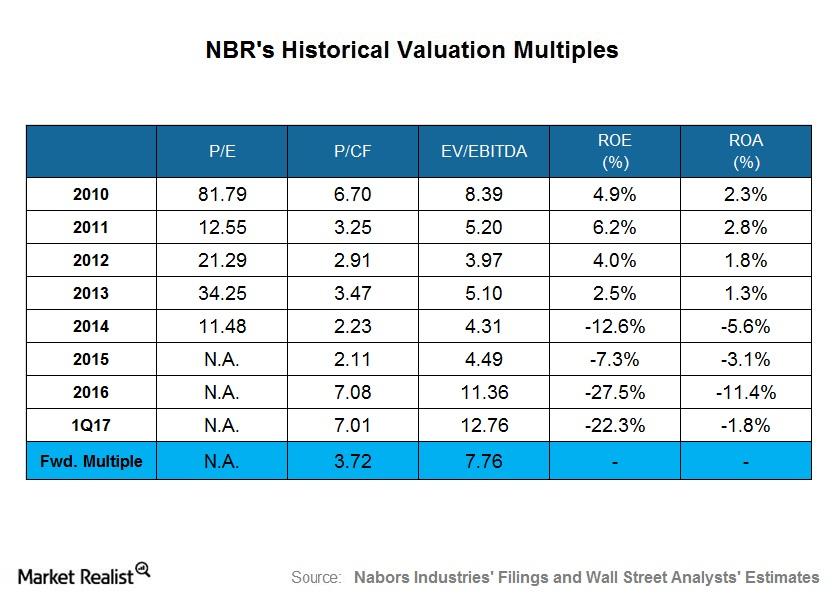

On March 31, 2017, Nabors Industries (NBR) stock was 20.0% lower than it was on December 30, 2016. In 1Q17, NBR’s adjusted earnings were negative.

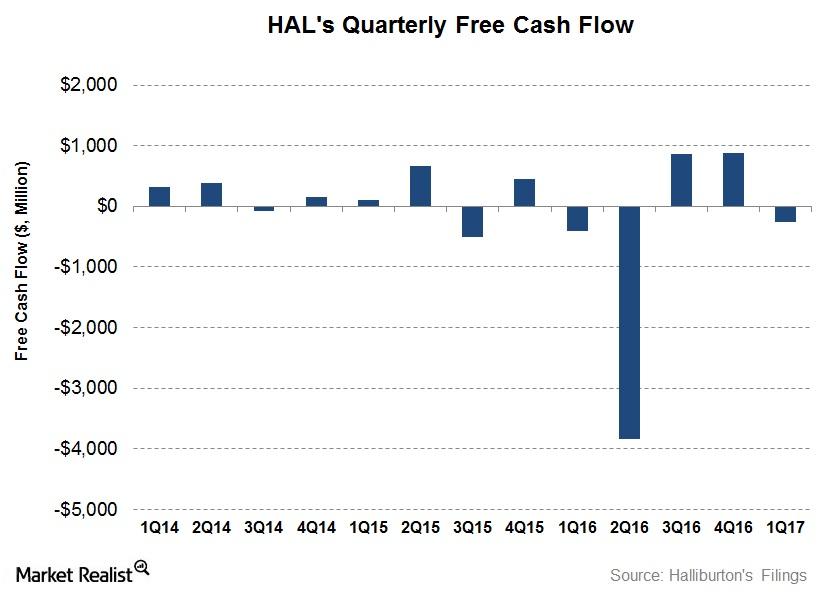

Behind Halliburton’s Free Cash Flow, Capex, and Acquisition Strategies

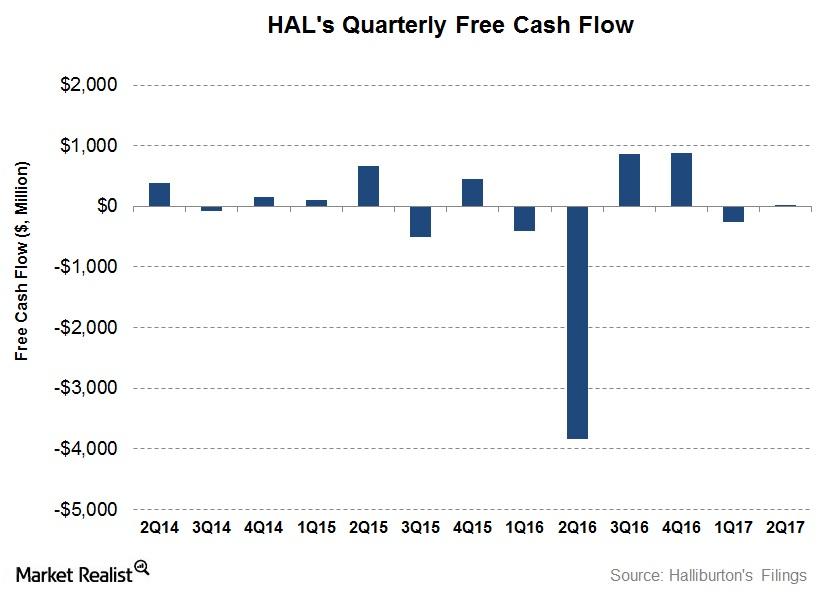

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17.

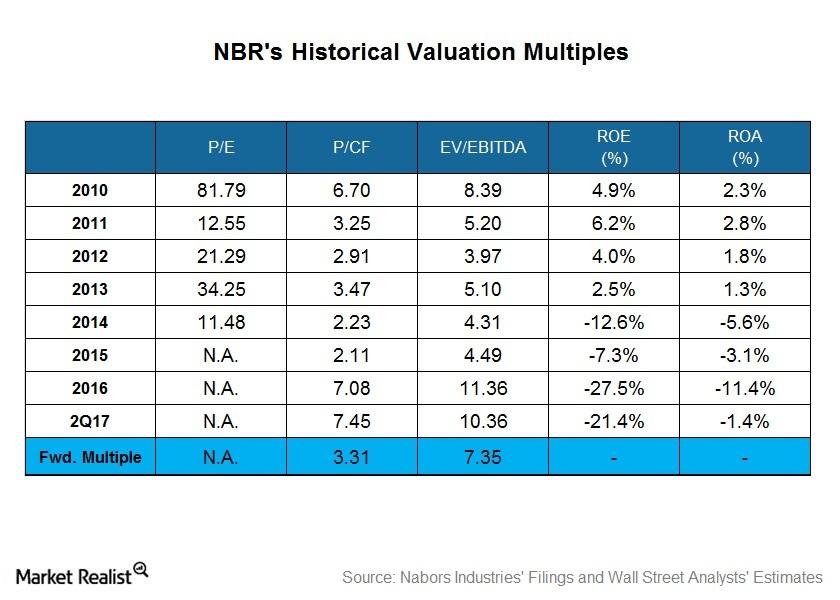

What Does Nabors Industries’ Historical Valuation Suggest?

Nabors Industries’ PE multiple was not meaningful in 2015 and 2016 as a result of negative adjusted earnings during this period.

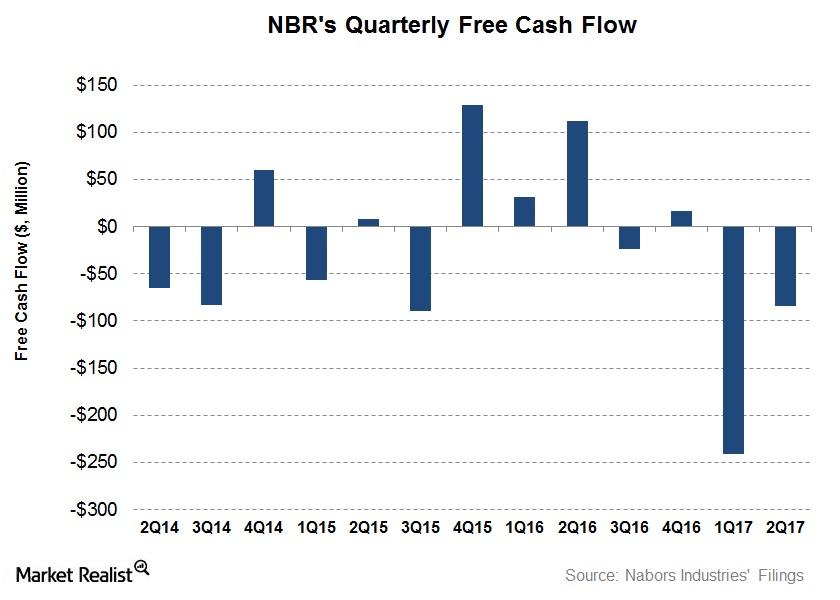

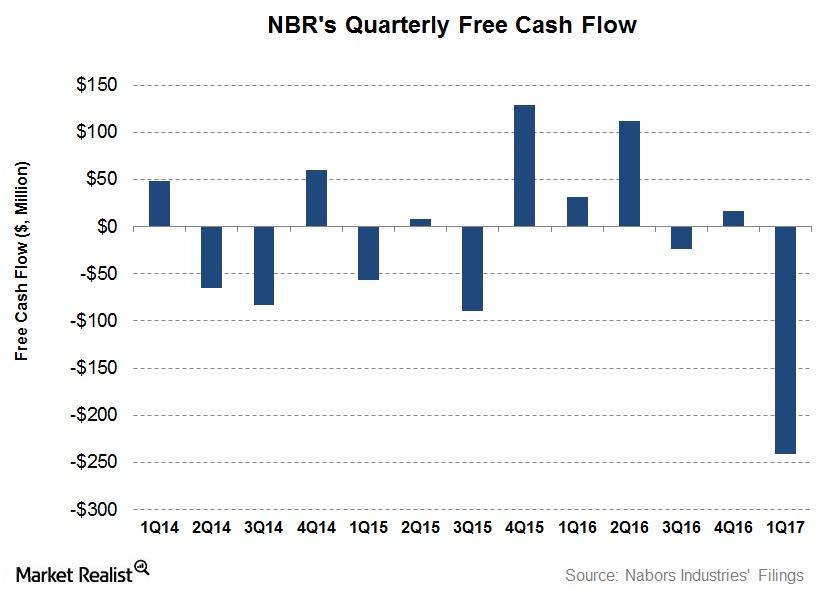

How Nabors Could Use Its Free Cash Flow This Year

Nabors Industries’ (NBR) CFO (cash from operating activities) turned positive in 2Q17, compared with its negative CFO in 1Q17.

What Are Nabors Industries’ Capex Plans for 2017?

Nabors Industries’ (NBR) cash from operating activities (or CFO) turned negative in 1Q17, compared to its positive CFO a year earlier.

Analyzing Halliburton’s Free Cash Flow and Capex Plans

Halliburton’s cash from operating activities (or CFO) in 1Q17 was an improvement over 1Q16, although it was a steep deterioration compared to 4Q16.

Short Interest: OFS Stocks with the Lowest Returns in 1Q17

Short interest in Nabors Industries (NBR), as a percentage of its float, rose to 11.5% as of March 31, 2017—compared to 6.5% as of December 30, 2016.

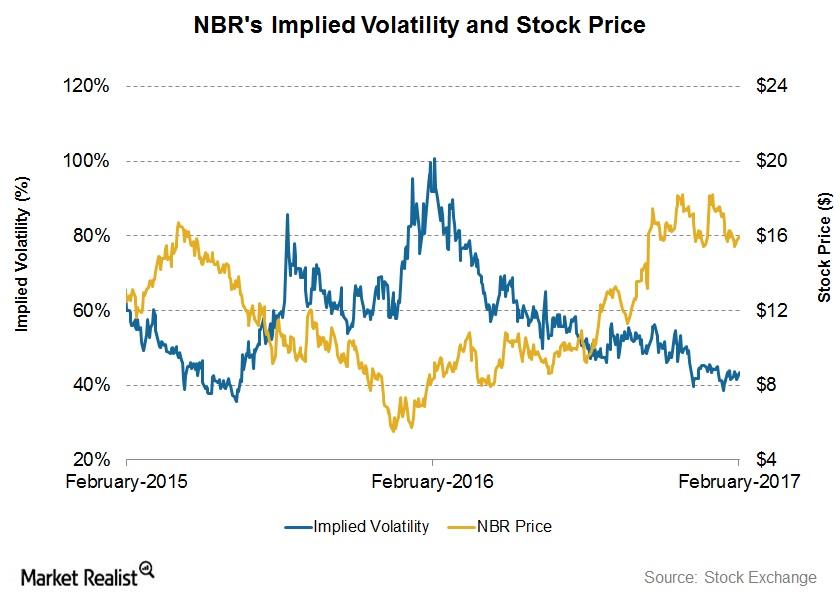

What Nabors Industries’ Implied Volatility Suggests

On February 13, 2017, Nabors Industries (NBR) had an implied volatility of 43%.

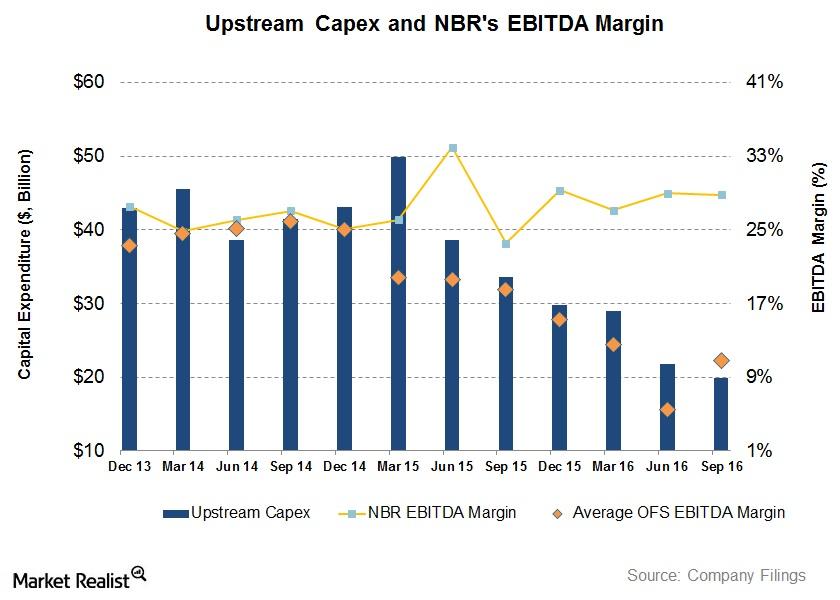

Will Upstream Operators’ Capex Affect Nabors’ 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure following crude oil prices’ sharp decline.

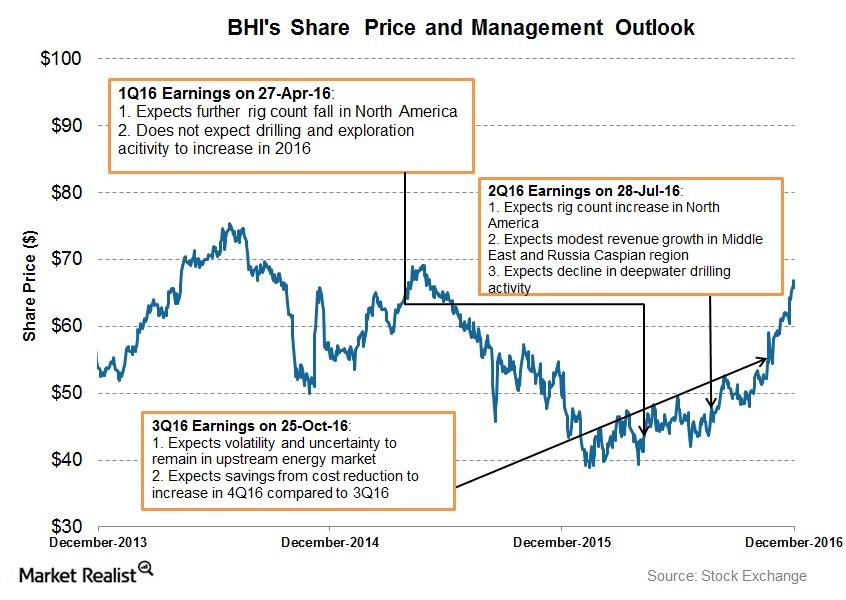

How Does Baker Hughes’s Management View 4Q16?

In 4Q16, Baker Hughes’s (BHI) management expects a trade-off between strong North American upstream activity and a weaker international energy environment.

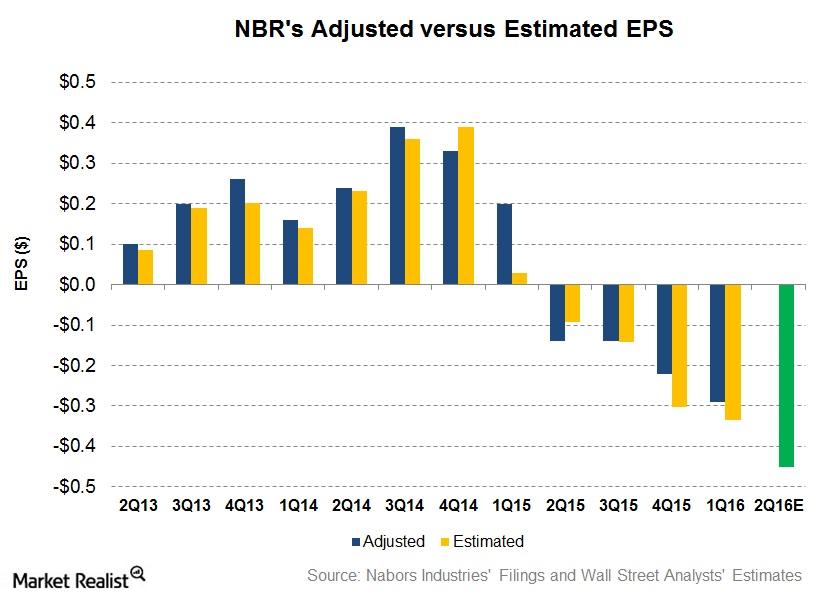

What Do Analysts Expect from Nabors Industries’s 2Q16 Earnings?

In 2Q16, Wall Street analysts expect an adjusted loss per share of $0.45 for Nabors Industries (NBR). NBR will release its 2Q16 financial results on August 2.

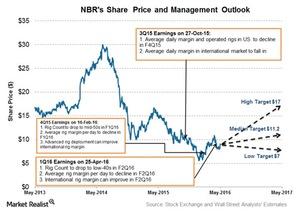

What Are Nabors Industries’ Management Views for 2016?

Nabors Industries’ management expects high performance rigs to perform better when the energy market recovery starts.