How Did GlaxoSmithKline’s Pharmaceuticals Segment Do in 2Q16?

GlaxoSmithKline’s (GSK) Pharmaceuticals segment declined substantially in 2015 due to the divestment of its oncology business to Novartis (NVS) in March 2015.

Aug. 2 2016, Updated 9:07 a.m. ET

The Pharmaceuticals segment

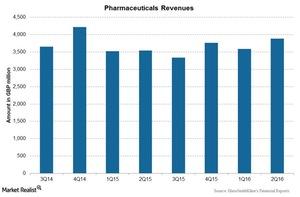

GlaxoSmithKline’s (GSK) Pharmaceuticals segment declined substantially in 2015 due to the divestment of its oncology business to Novartis (NVS) in March 2015. At constant exchange rates, the Pharmaceuticals segment reported a 2% growth in 2Q16 revenues at 3.9 billion pounds compared to 3.5 billion pounds in 2Q15.

The growth was driven by increased sales of HIV (human immunodeficiency virus) products Triumeq and Tivicay and new pharmaceutical products. These were partially offset by lower sales of Seretide and Advair.

Overall, the Pharmaceuticals segment’s contribution to total revenues declined from 60.4% in 2Q15 to ~59.4% in 2Q16. Let’s look now at the subsegments of the Pharmaceuticals segment. The segment is classified into the following two franchises:

- HIV products – marked under ViiV Healthcare

- Global Pharmaceuticals – respiratory, cardiovascular, metabolic and urology, immuno-inflammation, and established products

HIV products

HIV products are marketed under ViiV Healthcare, a company with GSK as a major shareholder and other shareholders such as Pfizer (PFE) and Shionogi. The company completed the acquisition of Bristol-Myers Squibb’s R&D (research and development) HIV assets on February 22, 2016, to strengthen its position in HIV products.

HIV products reported growth of 44% at constant exchange rates to 865 million pounds in 2Q16 over 2Q15. The growth is driven by the new products Tivicay and Triumeq, partially offset by declining sales of Epzicom/Kivexa.

Tivicay competes with Gilead Sciences’s (GILD) Stribild. Triumeq competes with Gilead’s and Bristol-Myers Squibb’s (BMY) jointly developed Atripla.

Global Pharmaceuticals

Global Pharmaceuticals include respiratory, cardiovascular, metabolic and urology, immuno-inflammation, and established products.

- For the respiratory franchise, Seretide and Advair are losing their market share to the generic competition. Overall, the respiratory franchise reported flat revenues of 1.6 billion pounds at constant exchange rates during 2Q16.

- For the cardiovascular and metabolic and urology franchise, Duodart and Jalyn have a strong performance, while Avodart, one of the key products of GSK, has been exposed to generic competition since October 2015. Franchise sales declined by 5% to 236 billion pounds at constant exchange rates during 2Q16.

- For the immuno-inflammation franchise, the new drug Benlysta is driving growth. Benlysta sales improved by ~29%, while franchise sales improved by 27% during 2Q16.

- Various products in the established products franchise are losing their market share to generic competition. Revenue fell 14% at constant exchange rates during 2Q16 due to lower sales across all markets.

Other Pharmaceuticals franchises include key products such as Augmentin, Relenza, dermatology products, and rare disease products. Revenues for this franchise declined 11% at constant exchange rates during 2Q16 following lower sales for Augmentin, dermatology, and rare disease products. They were partially offset by a strong performance for Volibris.

To divest risk, you can consider investing in ETFs such as the PowerShares International Dividend Achievers ETF (PID), which holds 2.9% of its total assets in GlaxoSmithKline.