3Q15 Earnings: Cabot Oil and Gas’s Revenue Missed Estimates

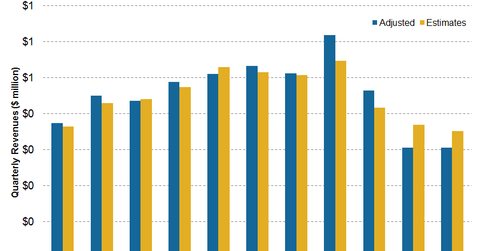

Wall Street analysts’ estimate for Cabot Oil and Gas’s revenue was ~$352 million for 3Q15. The company announced adjusted revenue of ~$305 million.

Oct. 29 2015, Updated 11:07 a.m. ET

Cabot Oil and Gas’s revenue

On October 23, Cabot Oil & Gas (COG) announced earnings for 3Q15, ended September 30. The company announced adjusted revenue of ~$305 million, versus a consensus or Wall Street analysts’ estimate of ~$352 million. The company’s revenue in the previous quarter had also missed analysts’ estimates, as the graph below notes.

Revenue analysis

The company’s revenue fell ~40.4% year-over-year. Compared to 2Q15, revenue was almost the same. As we can see in the graph above, Cabot Oil & Gas’s revenue has significantly fallen in 2015, compared to the previous quarters. As we noted in the previous part, this is because of a reduction in realized prices of natural gas and crude oil. Crude oil prices have fallen ~24% YTD, or year-to-date, while natural gas has fallen ~34% YTD. The company is predominantly a natural gas producer.

In the third quarter, natural gas prices fell ~9.3%, meaning lower realized prices, while prices had actually risen in the second quarter by ~8.7%, indicating higher realized prices in 2Q15. It’s interesting to note that revenue remained the same in the third quarter compared to the second quarter, despite a drop in natural gas prices. The reason for this is rising production in 3Q15. We’ll look at that production in the next part.

Peer comparison

Southwestern Energy (SWN) announced earnings on October 22. It reported an adjusted revenue of $749 million against an estimate of $805.5 million.

Antero Resources (AR) and Range Resources (RRC) are yet to announce their 3Q15 earnings. Analysts expect their respective revenues to come in at $533 million and $398 million.

All the above companies make up ~1.3% of the iShares North American Natural Resources ETF (IGE).

What drove Cabot Oil & Gas’s performance?

On the earnings call, Dan Dinges, the company’s Chairman, President, and CEO noted that the overall weaker financial metrics in the third quarter were a result of lower realized natural gas and oil prices, as they fell by 34% and 52%, respectively, compared to 3Q14.

Next, we’ll take a closer look at realized prices and operational performance in the third quarter.