Is Everything Going According to Plan for BHP Billiton?

BHP Billiton (BHP) (BBL), the world’s largest miner by market capitalization, reported its fiscal 2015 results on August 25. The results were mostly in line with market expectations.

Sept. 8 2015, Published 12:31 p.m. ET

In-line results

BHP Billiton (BHP) (BBL), the world’s largest miner by market capitalization, reported its fiscal 2015 results on August 25. The company held its conference call the same day. BHP’s fiscal 2015 ended on June 30.

The results were mostly in line with market expectations. Underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) and profits were $21.8 billion and $6.4 billion, respectively.

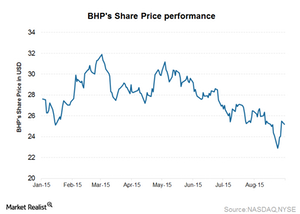

The day of the announcement, BHP’s stock price rose 5.5%. This was the day after the sharp sell-off in China. Year-to-date, iron ore mining companies have fallen considerably. BHP has been the most resilient among the iron ore names. Its stock has fallen 7.7% compared to 12%, 38%, and 43% falls for Rio Tinto (RIO), Vale SA (VALE), and Cliffs Natural Resources (CLF), respectively.

In this series, we’ll analyze BHP’s fiscal 2015 earnings. BHP has set certain targets for cost out and debt reduction. We’ll see if everything is going according to BHP’s plan by looking at key developments and outlook.

Company overview

BHP Billiton is a leading global diversified resources company. It’s one of the world’s largest major commodity producers. Its commodities include iron ore, metallurgical and energy coal, oil and gas, copper, nickel, and silver.

BHP is organized into the following four business units:

- petroleum and potash

- copper

- iron ore

- coal

BHP’s main focus is to own low-cost, long-life assets. In keeping with this focus, the company decided to spin off its assets that don’t meet these criteria into a separate company called South32 (SOUHY).

Investors can also consider investing in ETFs such as the SPDR S&P Metals and Mining ETF (XME), which invests in the metals and mining sector. All listings of BHP, RIO, and VALE form 32.1% of the iShares MSCI Global Metals & Mining Producers ETF (PICK). CLF forms 3.9% of XME’s holdings.

In the next article, we’ll look at the volumes for iron ore. Iron ore contributes the majority of BHP’s earnings, making up 40% of BHP’s fiscal 2015 EBITDA.