Spreads between High-Grade Bonds and Treasury Yields

If spreads widen further, high-grade bonds will become more attractive because yields and prices are inversely related. A rise in yields indicates falling prices.

Aug. 27 2015, Published 1:04 p.m. ET

What are high-grade bonds?

High-grade, or investment-grade, corporate bonds are debt instruments rated BBB- and above by rating major Standard & Poor’s. Other rating agencies have their own scale of rating a corporate bond investment-grade. Treasuries are also considered investment-grade.

ETFs such as the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), the Vanguard Short-Term Corporate Bond ETF (VCSH), and the SPDR Barclays Short Term Corporate Bond ETF (SCPB) help you invest in these instruments. LQD invests in investment-grade corporate bonds of companies such as Apple (AAPL), Morgan Stanley (MS), and Verizon (VZ).

High-grade bond yields

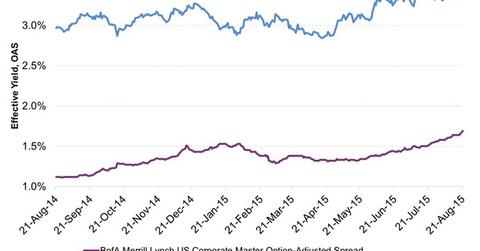

To assess the movement of high-grade bond yields, we’ll use the BofA Merrill Lynch US Corporate Master Effective Yield. The above graph shows that yields according to this measure have risen nearly uniformly in the past year. On August 18, 2015, yield by this measure stood at 3.42%, the highest since September 17, 2013.

Spreads in 2015

The BofA Merrill Lynch Option-Adjusted Spread (or OAS) measures the average difference in yields between investment-grade bonds and Treasuries.

If spreads are rising or widening, credit conditions can be assumed to be worsening. Spreads widen also when growth is slow and economic conditions are worsening. Conversely, falling or tightening spreads coincide with faster growth and generally better economic conditions.

In 2014, spreads by this measure ranged from 1.06% to 1.51%. In 2015, until August 21, spreads have ranged between 1.29% and 1.69%. Spreads fell in the first four months of 2015. Currently, however, spreads stand at 1.69% according to the above measure. This is the widest that spreads have been since June 26, 2013. However, if we look at spreads since 2007, spreads were their widest at 6.56% in December 2008.

This shows that although credit and economic conditions are not very bad, they’re worse than they were in 2014. If spreads widen further, high-grade bonds will become more attractive because yields and prices are inversely related. A rise in yields indicates falling prices. Investors should also look at this situation from the perspective of risk because widening spreads make an investment riskier.

A rise in high-grade bond yields has also impacted high-grade bond issuance. Let’s look at that in the next article.