SPDR® Barclays Short Term Corp Bd ETF

Latest SPDR® Barclays Short Term Corp Bd ETF News and Updates

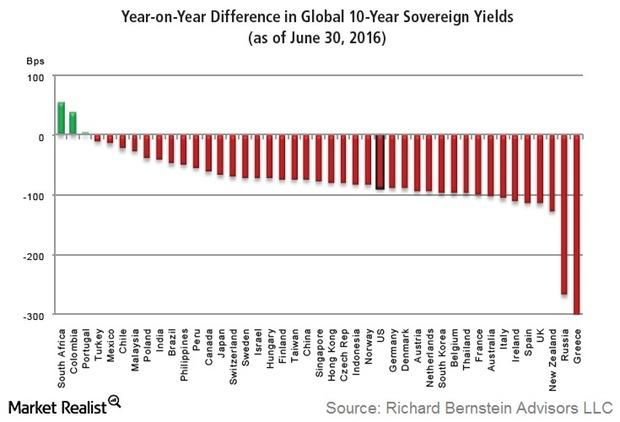

Richard Bernstein: Falling Yields Are Testimony to Risk Aversion

Bernstein asked a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

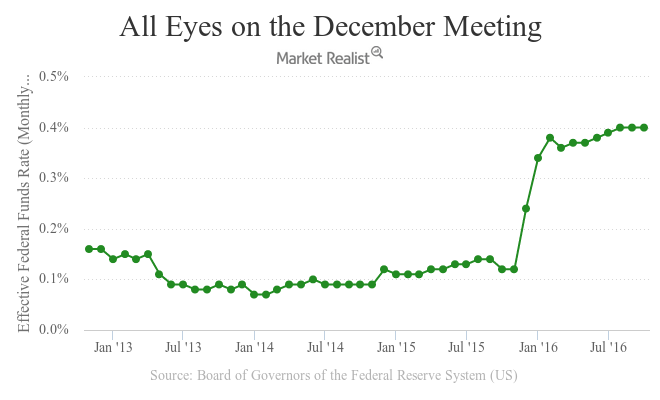

A Pass on a November Hike: It’s Up to December Now

The expected occurred on November 2, 2016, when the FOMC (Federal Open Market Committee) left the federal funds rate unchanged at 0.25%–0.5%.