Why Diversification Is More than Just a Buzzword

Diversification is important because a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security.

Nov. 20 2020, Updated 11:30 a.m. ET

Myopic loss aversion. According to this behavioral finance notion, people feel the pain from losses much more acutely than they feel the joy from similar size gains, and they tend to evaluate returns over a relatively short time period. These tendencies can lead investors to strongly avoid short-term losses, making it especially painful for investors to step into EMs after recent market volatility.

To tackle this bias, investors need to become more comfortable with the downside risks of EM investing. One way to do this is to consider EM investments as part of one’s overall portfolio, rather than just looking at them in isolation. Riskier equities may seem less like isolated gambles when they’re considered in a broader portfolio diversification context, given that they aren’t usually perfectly correlated with other assets.

Market Realist: Diversification is more than just a buzzword.

As we saw in Part two of this series, emerging markets (EEM) aren’t perfectly correlated to the S&P 500 (SPY) nor to developed market stocks (EFA).

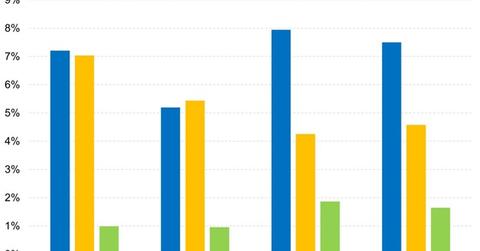

Let’s look at an example to understand why portfolio diversification is important. The graph above compares ten years’ worth of monthly returns generated by EEM, EFA, SPY, and a hypothetical portfolio with the standard deviation. The hypothetical portfolio is weighted with 25% in EEM, 25% in EFA, and 50% in SPY. Standard deviation is a measure of risk.

The S&P 500 has the best CAGR of 7.9%, with a relatively low standard deviation at 4.2%. While the index has produced better risk-adjusted returns than the hypothetical portfolio has, it’s mainly because of the secular bull market seen in American stocks during this period. In the same time frame, EFA and EEM were struggling.

Usually, though, a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security. Also, given that US stocks (VTI) are likely to become more volatile (VXX) going forward, you’re unlikely to see such returns from American stocks in the long term.