Supply Disruptions in 2015 Support Copper Prices

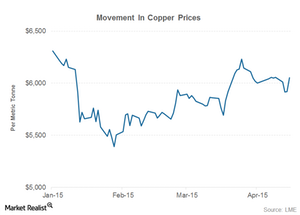

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.

April 21 2015, Published 11:55 a.m. ET

Copper prices

In the first part of our series, we looked briefly at the Wall Street performance of copper companies. Copper prices are a key driver for copper producers including Southern Copper (SCCO) and Anglo American (AAUKY).

Freeport-McMoRan (FCX) expects its EBITDA (earnings before interest, taxes, depreciation, and amortization) to fall by $500 million for every $0.10 per pound decline in copper prices. The reverse is true when copper prices go up.

Freeport currently forms 3.41% of the iShares U.S. Basic Materials ETF (IYM) and 3.11% of the Materials Select Sector SPDR ETF (XLB). Newmont Mining (NEM) forms 1.91% of XLB.

Copper prices steady

The previous chart shows the movement in copper prices on the LME (London Metal Exchange). Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%, and aluminum prices have dropped 3% over this period.

Supply disruptions

There have been supply-side disruptions, including incessant rains and floods in Chile, the world’s largest copper miner. Chile also has the highest reserves of copper, followed by Peru. The Chilean copper association has reduced its production targets for 2015 as a result of weather disruptions.

There have also been mining operation disruptions in Indonesia. The country imposed a ban on exports of unprocessed ores. Indonesian bauxite and copper exports have been negatively impacted as a result. If this weren’t enough, workers blockaded PT Freeport’s Grasberg Mine in Indonesia.

Investors in copper companies should closely track copper production figures. In the next part of our series, we’ll discuss the latest copper production trends.