J.P. Morgan: Commercial Banking and Firm-Wide Synergies

J.P. Morgan Commercial Banking clients can access the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network.

April 22 2015, Updated 12:13 p.m. ET

Segment overview

J.P. Morgan’s (JPM) Commercial Banking segment offers lending, Treasury services, investment banking, and asset management services. The services are offered to corporations, municipalities, financial institutions, and nonprofit entities with annual revenue typically ranging from $20 million to $2 billion. The segment also provides financing to real estate investors.

The segment selects clients with strong management track records that are well regarded in their local markets. This helps reduce overall risk.

Synergies between segments

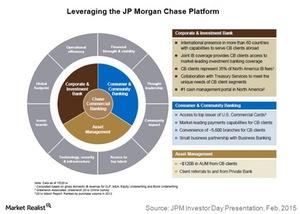

There are significant synergies between Commercial Banking and other segments. Commercial Banking benefits from the firm’s international presence in Corporate and Investment Banking. Commercial Banking clients can also access the firm’s investment banking and Treasury services.

Similarly, Commercial Banking clients get access to the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network. There are client referrals to and from the firm’s Asset Management segment. The figure above describes how the Commercial Banking segment leverages the J.P. Morgan Chase platform.

Commercial real estate loans

J.P. Morgan’s commercial real estate loan portfolio grew at a CAGR (compound annual growth rate) of 10% over the last five years, compared to an industry CAGR of 2%. The growth was partly fueled by loan originations.

Wells Fargo (WFC) leads in commercial real estate lending. Bank of America (BAC) also has big operations in this segment. Citigroup (C), on the other hand, has a relatively small real estate loan portfolio.

J.P. Morgan makes up ~5.5% of the Vanguard Financials ETF (VFH).