What caused the WTI-Brent spread to widen?

Capping the month with a gain of 3.1% since January 30, WTI’s (West Texas Intermediate) increase has been small compared to Brent’s 18% increase.

March 12 2015, Updated 5:05 p.m. ET

WTI-Brent

Capping the month with a gain of 3.1% since January 30, WTI’s (West Texas Intermediate) increase has been small in comparison to the 18% increase Brent saw during the same period.

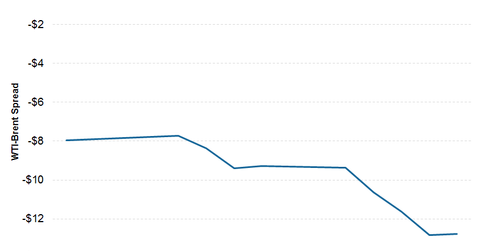

As a result, the divergence between the two benchmarks is currently trading in the vicinity of $12.

To put this into perspective, the benchmarks were trading near parity in January.

US supplies are at the center of this matter. Increasing domestic supplies have been keeping WTI from advancing as much as Brent. Refinery outages have also been impacting prices lately.

Brent was finding support in supply disruptions in Libya.

The price gap seems to be adhering to OPEC’s (Organization of the Petroleum Exporting Countries) strategy. Last year, OPEC decided to keep its output steady to defend market share.

While both the benchmark prices at current prices are painful for oil producers, OPEC producers whose selling prices are mostly based on Brent, won’t be struggling as much as their US counterparts. Some of their US counterparts are struggling to breakeven.

As a result, US producers—like Anadarko Petroleum (APC), ConocoPhillips (COP), Apache Corp. (APA), and Hess Corp. (HES)—will continue to struggle. US supplies will keep WTI from advancing as much as their international benchmark—even as the US keeps producing oil that can’t be exported.

All of these companies are part of the Energy Select Sector SPDR ETF (XLE). They account for ~10.3% of XLE.

In the next part of this series, we’ll discuss the EIA’s (U.S. Energy Information Administration) forecasts for oil prices in 2015.