Greece Debt Drama: What’s Next?

Keep a close eye on further developments in the unfolding Greek debt drama and hope that it does not turn into a tragedy.

Oct. 11 2020, Updated 12:00 p.m. ET

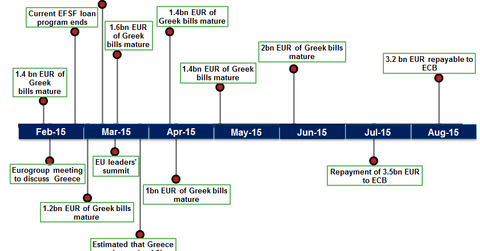

Key dates to watch. Mid-February: The European Union is likely to grant an extension to the bailout timetable. End of June: When bond payments to the ECB come due.

Market Realist – The following is a brief timeline of key dates to watch for what’s next in the Greece debt drama:

February 11, 2015: An emergency meeting of finance ministers of the Eurozone will take place. Greece will also lose access to the cheap funding from the ECB (European Central Bank) on that day. This follows ECB’s refusal last week to accept Greek government bonds as collateral for loans. Greek banks would now have to turn to the Emergency Liquidity Assistance scheme (or ELA), which charges an interest rate of 1.55% compared to the 0.05% rate available currently.

- February 12, 2015: Leaders of the Eurozone meet in Brussels, which marks EU’s first meeting since election of Alexis Tsipras. The agenda does not discuss Greece debt per se, but fringe meetings with other council members could be in the cards for the Prime Minister.

- February 16, 2015: This date marks the deadline for Greece’s bid to re-apply for the bailout.

- February 18, 2015: A crucial ECB governing council meeting will decide whether ECB will continue to give funding in the form of ELA to Greece. If ECB stops funding, the possibility of a Greek exit would loom large.

- February 28, 2015: This is another crucial date, as Greece will receive its final installment worth 7.2 billion euros from the troika. If no deal is brokered by this date, Greece would lose access to the last installment of 1.2 billion euros from the Eurozone. In such a scenario, a Greek default on payment to creditors would be in the cards.

- July 20, 2015: Repayment on bonds worth 3.5 billion euros to the ECB would fall due. Greece is likely to run out of cash afterwards.

- August 20, 2015: Repayment on bonds worth 3.2 billion euros would fall due.

Greece (GREK) needs to repay 1.5 billion euros, in March, June, and September. The IMF, being a lender of last resort, does not have a policy to restructure loans, and the Greek government has conceded that it would not test the resolve of the IMF.

Greece will continue to stay a point of contention for not just the Eurozone (EZU), but also the US (SPY) and global markets (ACWI) in the months to come. The uncertainty is likely to add a fresh lease of volatility (VXX) to the global markets (QWLD). A Greek exit could shake the euro and rattle the global markets. Many analysts have predicted “Lehman Squared”, a financial contagion of epic proportions that could be sparked by a Greek exit. All said and done, keep a close eye on further developments in the unfolding Greek debt drama and hope that it does not turn into a tragedy.

Read our series European Euphoria is not likely to last to understand more about the politics at play in the Eurozone.