Why Gold Has Performed Better When Interest Rates Are Lower

J.P. Morgan’s analysis states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment.

June 10 2016, Updated 8:05 a.m. ET

That said, some environments have been more kind to gold than others. As gold pays no interest or dividend, the opportunity cost of holding the precious metal is a critical driver of returns. During periods of low or negative real rates, when the opportunity cost is low, gold has generally performed better than in periods when real rates are higher.

My colleague Heidi Richardson also mentioned this in a recent post. According to Bloomberg data, since 1971, the level of real U.S. 10-year yields has explained roughly 35 percent of the annual change in the price of gold. In those years in which real rates were above average (roughly 2.50 percent), gold rose by an average of 0.50 percent. However, in those years when rates were below the historical average, gold rose by an average of 21 percent.

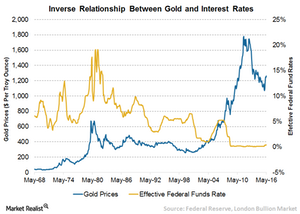

Market Realist – Gold has inverse relationship with interest rates

Although it is difficult to predict the movement of gold, some historical pattern is clearly visible during this economic situation. The price of gold (IAU) is generally inversely related to the interest rate environment.

During a higher interest rate scenario, the price of gold normally trends lower and is under-controlled. On the other hand, lower interest rates are likely to drive the prices higher.

Inverse relationship

This relationship between gold and rates has been confirmed by J.P. Morgan’s analysis, which states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment. J.P. Morgan’s analysis further showed that monthly returns for gold averaged 1.4% during periods of low and falling real interest rates in the US (SPY) (IVV), compared with a long-run average of 0.4%.

J.P. Morgan added, “The move from a perceived ‘low and rising’ real interest rate environment to a ‘low and falling’ scenario would be supportive for gold.”

Prevalent scenario

In the present scenario, we have seen a lower and negative interest rate environment in many developed (EFA) (IEFA) countries. The Bank of Japan cut rates to -0.1% in January while the European Central Bank cut rates to -0.4% in March.

Similarly, Sweden cut its rates to -0.5% in April while the Federal Reserve is taking a very cautious stance to raise rates. Conversely, gold is trending higher and is up by 18% year-to-date.