BTC iShares Core MSCI EAFE ETF

Latest BTC iShares Core MSCI EAFE ETF News and Updates

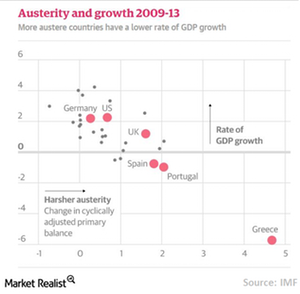

Assessing the Paradigm Shift in the Fiscal Policy

Fiscal policy has turned more expansionary, with stress on fiscal spending and monetary easing, thereby flooding the financial markets worldwide with huge liquidity.

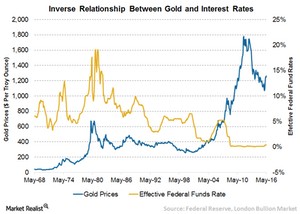

Why Gold Has Performed Better When Interest Rates Are Lower

J.P. Morgan’s analysis states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment.