The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.

May 3 2021, Updated 11:01 a.m. ET

To aid in the celebration, here are a few investment ideas that may go against the grain from a tax perspective but that could enhance future performance and minimize risks in your portfolio.

Bring your portfolio back into better balance

Have you let your winners ride during the past five years to avoid a capital gains tax hit? If so, then your portfolio may have morphed into ever higher risk exposures. If you are over exposed to stocks (IVV) and corporate bonds, both investment grade (AGG) and high yield (HYG) as a result of their impressive gains, then ask whether these exposures are still appropriate or if you might want to consider rebalancing toward other assets that could potentially provide ballast, such as government bonds (TLT), or add diversification, international funds.

Market Realist – All the benefits of diversification can evaporate if your winning stocks accumulate and you don’t rebalance your portfolio. Many investors don’t rebalance their portfolio because they’re afraid of getting hit with a capital gains tax.

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. For example, if the ideal asset allocation ratio for an investor is 75% stocks and 25% bonds, but gains in stocks pushed the ratio to 80% stocks and 20% bonds, rebalancing would mean selling the excess 5% stocks and investing in bonds.

Not rebalancing can expose you to higher risk. It may distort your original asset allocation mix. Rebalancing should be followed as a discipline. Investment strategies should act as motivation behind selling and buying stocks. Implications of a higher capital gains tax shouldn’t cloud your judgement.

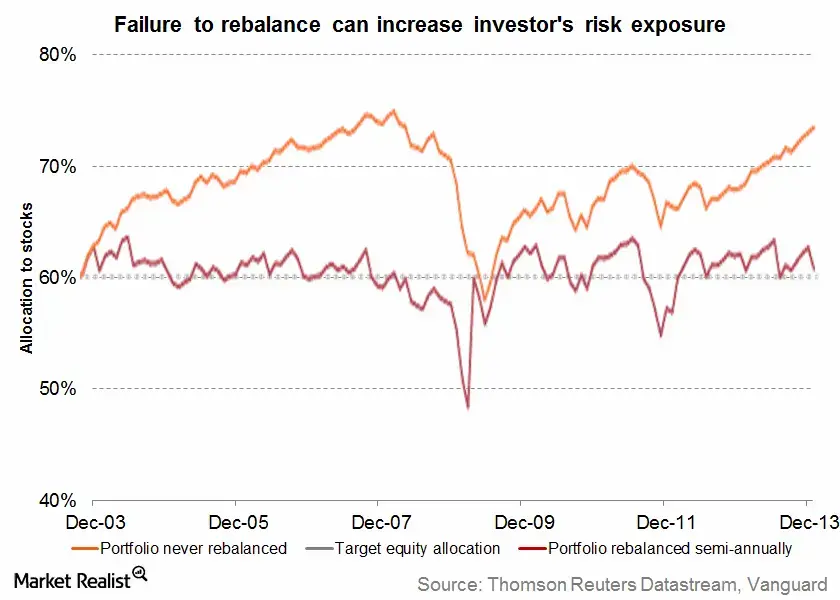

Market Realist – The graph above shows the changes in stock exposure for a portfolio that was rebalanced in June and December. The rebalanced portfolio is compared to a portfolio that wasn’t rebalanced.

In 2013, the initial allocation for both of the hypothetical portfolios is fixed at 60% to US equities (SPY) and global equities (QWLD). The portfolios are fixed at 40% to bonds (BND). Now, we’ll trace the portfolios’ movements with market movements.

At the end of 2007, the allocation to equities for the the portfolio that wasn’t rebalanced would have reached 75%. This would expose the portfolio to much greater risk. The results would have been catastrophic because this was when the financial crisis shook the US economy. In contrast, the rebalanced portfolio would have been at 60% equity allocation.

In the next part of this series, we’ll discuss how you need to let go of defensive stocks that have become very expensive.