Non-operating expenses eclipse Gol’s operating profitability

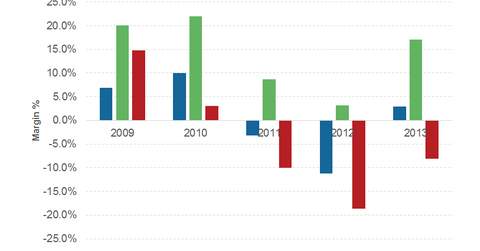

Gol’s operating income turned positive in FY13 after reporting losses for two consecutive years.

Dec. 4 2014, Updated 12:00 p.m. ET

Operating profitability

Gol’s operating income turned positive in FY13 after reporting losses for two consecutive years. Gol reported losses in FY11 and FY12 in spite of a 8% and 7.5% increase in revenue, respectively. This was mainly due to higher fuel costs and interest expenses. Aircraft fuel expense as a percentage of revenue increased from 30% in FY09 to 46% in FY12, and interest expenses grew at ~39% year-over-year in FY11 and 9% in FY12.

In 2013, however, operating margin improved to 3% in FY13. Improvement in yield drove margins, which resulted in a ~19% increase in unit revenue, or passenger revenue per available seat kilometers to 16.4 centavos in FY13. Gol expects an operating margin between 3% to 6% for FY14.

Margin comparison with US airlines

Gol is at a competitive disadvantage with its US peers due to higher fuel cost of airlines operating in Brazil. Recently, US airlines have reported higher margins. In FY13, Delta (DAL) reported an operating margin of 9%, American reported 5.2%, and Alaska reported 16.3%. Even Gol’s low-cost US peers Southwest (LUV) and JetBlue (JBLU) reported higher margins of 7.2% and 7.9%, respectively. However, Gol reported positive EBITDAR (or operating income excluding depreciation, amortization, and rental expenses) margin in all five years between 2009 and 2013.

Investors can invest in US airlines through ETFs such as the iShares Transportation Average ETF (IYT) and the SPDR S&P Transportation ETF (XTN). The Brazil Small-Cap ETF (BRF) and the Brazil Consumer ETF (BRAQ) invests in shares of Gol.

Non-operating expenses drive down profitability

Gol’s net income was impacted by high interest expense, tax expense, and expenses related to exchange rate changes. In FY13, Gol’s interest expense increased by 17% year-over-year, and expenses related to net exchange rate changes increased by 72%. The increase in these non-operating expenses offset the 50% increase in investment income and resulted in negative net income of 725 million real.